Xerox 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67Xerox 2011 Annual Report

Document outsourcing services include service arrangements that allow

customers to streamline, simplify and digitize their document-intensive

business processes through automation and deployment of software

application and tools and the management of their printing needs.

Document outsourcing also includes revenues from our partner print

services offerings. Business process outsourcing services includes service

arrangements where we manage a customer’s business activity or process.

Information technology outsourcing services include service arrangements

where we manage a customer’s IT-related activities, such as application

management and application development, data center operations or

testing and quality assurance.

The segment classified as Other includes several units, none of which

meets the thresholds for separate segment reporting. This group primarily

includes Xerox Supplies Business Group (predominantly paper sales), Wide

Format Systems, licensing revenues, GIS network integration solutions

and electronic presentation systems and non-allocated Corporate items

including non-financing interest, as well as other items included in Other

expenses, net.

Our Technology segment is centered on strategic product groups, which

share common technology, manufacturing and product platforms. This

segment includes the sale of document systems and supplies, technical

services and product financing. Our products range from:

•“Entry,”which includes A4 devices and desktop printers; to

•“Mid-range,” which includes A3 devices that generally serve workgroup

environments in midsize to large enterprises and includes products that

fall into the following market categories: Color 41+ ppm priced at less

than $100K and Light Production 91+ ppm priced at less than $100K; to

•“High-end,” which includes production printing and publishing systems

that generally serve the graphic communications marketplace and

large enterprises.

The Services segment is comprised of three outsourcing service offerings:

•Document Outsourcing (which includes Managed Print Services) (“DO”)

•Business Process Outsourcing (“BPO”)

•Information Technology Outsourcing (“ITO”).

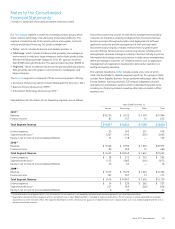

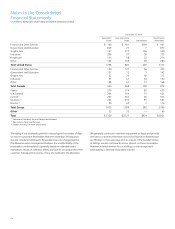

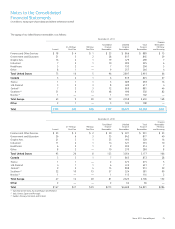

Selected financial information for our Operating segments was as follows:

Years Ended December 31,

Services Technology Other Total

2011(1)

Revenue $ 10,754 $ 9,722 $ 1,518 $ 21,994

Finance income 83 537 12 632

Total Segment Revenue $ 10,837 $ 10,259 $ 1,530 $ 22,626

Interest expense 25 202 251 478

Segment profit (loss)(2) 1,207 1,140 (255) 2,092

Equity in net income of unconsolidated affiliates 31 118 — 149

2010(1)

Revenue $ 9,548 $ 9,790 $ 1,635 $ 20,973

Finance income 89 559 12 660

Total Segment Revenue $ 9,637 $ 10,349 $ 1,647 $ 21,633

Interest expense $ 28 $ 212 $ 352 $ 592

Segment profit (loss)(2) 1,132 1,085 (342) 1,875

Equity in net income of unconsolidated affiliates 16 62 — 78

2009(1)

Revenue $ 3,373 $ 9,470 $ 1,623 $ 14,466

Finance income 103 597 13 713

Total Segment Revenue $ 3,476 $ 10,067 $ 1,636 $ 15,179

Interest expense $ 36 $ 229 $ 262 $ 527

Segment profit (loss)(2) 231 949 (342) 838

Equity in net income of unconsolidated affiliates 8 33 — 41

(1) Asset information on a segment basis is not disclosed, as this information is not separately identified and internally reported to our chief executive officer.

(2) Depreciation and amortization expense, which is recorded in cost of sales, RD&E and SAG, is included in segment profit above. This information is neither identified nor internally

reported to our chief executive officer. The separate identification of this information for purposes of segment disclosure is impracticable, as it is not readily available and the cost to

develop it would be excessive.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)