Xerox 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

53Xerox 2011 Annual Report

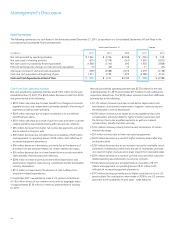

Pro-forma:

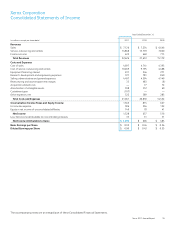

Year Ended December 31,

As Reported Pro-forma(1) As Reported Change Pro-forma Change

(in millions) 2011 2010 2009 2010 2009 2011 2010 2011 2010(2)

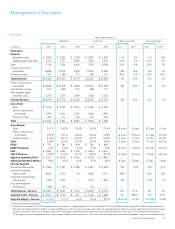

Total Xerox

Revenue:

Equipment sales $ 3,856 $ 3,857 $ 3,550 $ 3,857 $ 3,550 —% 9% —% 9%

Supplies, paper and other 3,270 3,377 3,096 3,402 3,234 (3)% 9% (4)% 4%

Sales 7,126 7,234 6,646 7,259 6,784 (1)% 9% (2)% 7%

Service, outsourcing

and rentals 14,868 13,739 7,820 14,333 13,585 8% 76% 4% 1%

Finance income 632 660 713 660 713 (4)% (7)% (4)% (7)%

Total Revenues $ 22,626 $ 21,633 $ 15,179 $ 22,252 $ 21,082 5% 43% 2% 3%

Service, outsourcing

and rentals $ 14,868 $ 13,739 $ 7,820 $ 14,333 $ 13,585 8% 76% 4% 1%

Add: Finance income 632 660 713 660 713

Add: Supplies, paper

and other sales 3,270 3,377 3,096 3,402 3,234

Annuity Revenue $ 18,770 $ 17,776 $ 11,629 $ 18,395 $ 17,532 6% 53% 2% 1%

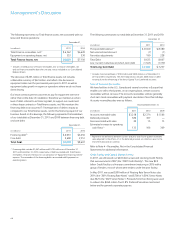

Gross Profit:

Sales $ 2,429 $ 2,493 $ 2,251 $ 2,494 $ 2,269

Service, outsourcing

and rentals 4,599 4,544 3,332 4,646 4,585

Finance income 401 414 442 414 442

Total $ 7,429 $ 7,451 $ 6,025 $ 7,554 $ 7,296

Gross Margin:

Sales 34.1% 34.5% 33.9% 34.4% 33.4% (0.4) pts 0.6 pts (0.3) pts 1.1 pts

Service, outsourcing

and rentals 30.9% 33.1% 42.6% 32.4% 33.8% (2.2) pts (9.5) pts (1.5) pts (0.7) pts

Finance income 63.4% 62.7% 62.0% 62.7% 62.0% 0.7 pts 0.7 pts 0.7 pts 0.7 pts

Total 32.8% 34.4% 39.7% 33.9% 34.6% (1.6) pts (5.3) pts (1.1) pts (0.2) pts

RD&E $ 721 $ 781 $ 840 $ 781 $ 840

RD&E % Revenue 3.2% 3.6% 5.5% 3.5% 4.0% (0.4) pts (1.9) pts (0.3) pts (0.4) pts

SAG $ 4,497 $ 4,594 $ 4,149 $ 4,653 $ 4,651

SAG % Revenue 19.9% 21.2% 27.3% 20.9% 22.1% (1.3) pts (6.1) pts (1.0) pts (0.9) pts

Adjusted Operating Profit $ 2,211 $ 2,076 $ 1,036 $ 2,120 $ 1,805

Adjusting Operating Margin 9.8% 9.6% 6.8% 9.5% 8.6% 0.2 pts 2.8 pts 0.3 pts 1.0 pts

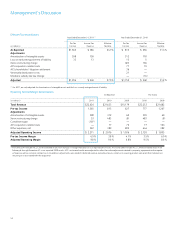

Services Segment

Document Outsourcing $ 3,584 $ 3,297 $ 3,382 $ 3,297 $ 3,382 9% (3)% 9% (3)%

Business Processing

Outsourcing(2) 6,035 5,112 94 5,603 4,751 18% * 8% 8%

Information Technology

Outsourcing 1,326 1,249 — 1,377 1,246 6% * (4)% —%

Less: Intra-segment

Eliminations (108) (21) — (21) — * * * *

Total Revenue – Services $ 10,837 $ 9,637 $ 3,476 $ 10,256 $ 9,379 12% 177% 6% 3%

Segment Profit – Services $ 1,207 $ 1,132 $ 231 $ 1,166 $ 1,008 7% 390% 4% 12%

Segment Margin – Services 11.1% 11.7% 6.6% 11.4% 10.7% (0.6) pts 5.1 pts (0.3) pts 1.0 pts

* Percentage change not meaningful.

(1) 2010 pro-forma includes ACS’s 2010 estimated results from January 1 through February 5, 2010 in our reported 2010 results. 2009 pro-forma includes ACS’s 2009 estimated results from

February 6 through December 31, 2009 in our reported 2009 results. The ACS results were adjusted to reflect fair value adjustments related to property, equipment and computer software

as well as customer contract costs. In addition, adjustments were made for deferred revenue, exited businesses and other material non-recurring costs associated with the acquisition.

(2) 2010 changes for Xerox excluding ACS results for gross margin, RD&E and SAG were (0.2) pts, (0.5) pts and (0.8) pts, respectively, which were comparable to the pro-forma changes noted.