Xerox 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

Except for the ASUs discussed above, the remaining ASUs issued by

the FASB during the year entail technical corrections to existing

guidance or affect guidance related to unique/infrequent transactions

or specialized industries/entities and therefore have minimal, if any,

impact on the Company.

Summary of Accounting Policies

RevenueRecognition

We generate revenue through services, the sale and rental of equipment,

supplies and income associated with the financing of our equipment sales.

Revenue is recognized when earned. More specifically, revenue related to

services and sales of our products is recognized as follows:

Equipment: Revenues from the sale of equipment, including those from

sales-type leases, are recognized at the time of sale or at the inception

of the lease, as appropriate. For equipment sales that require us to install

the product at the customer location, revenue is recognized when the

equipment has been delivered and installed at the customer location.

Sales of customer-installable products are recognized upon shipment

or receipt by the customer according to the customer’s shipping terms.

Revenues from equipment under other leases and similar arrangements

are accounted for by the operating lease method and are recognized as

earned over the lease term, which is generally on a straight-line basis.

Services: Technical service revenues are derived primarily from

maintenance contracts on our equipment sold to customers and are

recognized over the term of the contracts. A substantial portion of our

products are sold with full service maintenance agreements for which the

customer typically pays a base service fee plus a variable amount based

on usage. As a consequence, other than the product warranty obligations

associated with certain of our low-end products, we do not have any

significant product warranty obligations, including any obligations under

customer satisfaction programs.

Revenues associated with outsourcing services are generally recognized

as services are rendered, which is generally on the basis of the number of

accounts or transactions processed. Information technology processing

revenues are recognized as services are provided to the customer,

generally at the contractual selling prices of resources consumed or

capacity utilized by our customers. In those service arrangements where

final acceptance of a system or solution by the customer is required,

revenue is deferred until all acceptance criteria have been met. Revenues

on cost-reimbursable contracts are recognized by applying an estimated

factor to costs as incurred, determined by the contract provisions and

prior experience. Revenues on unit-price contracts are recognized at

the contractual selling prices as work is completed and accepted by the

customer. Revenues on time-and-materials contracts are recognized at

the contractual rates as the labor hours and direct expenses are incurred.

In connection with our services arrangements, we incur costs to originate

these long-term contracts and to perform the migration, transition and

setup activities necessary to enable us to perform under the terms of the

arrangement. Initial direct costs of an arrangement are capitalized and

amortized over the contractual service period. We also capitalize certain

incremental direct costs that are related to the contract origination or

transition, implementation and setup activities and amortize them over

the term of the arrangement. From time to time, we also provide certain

inducements to customers in the form of various arrangements, including

contractual credits, which are capitalized and amortized as a reduction of

revenue over the term of the contract. Customer-related deferred set-up/

transition and inducement costs were $294 and $134 at December 31,

2011 and 2010, respectively, and are amortized over a weighted average

period of approximately eight years. Amortization expense associated

with customer-related contract costs at December 31, 2011 is expected to

be approximately $80 in 2012.

Long-lived assets used in the fulfillment of the arrangements are

capitalized and depreciated over the shorter of their useful life or the term

of the contract if an asset is contract-specific.

Revenues on certain fixed-price contracts where we provide information

technology system development and implementation services are

recognized over the contract term based on the percentage of

development and implementation services that are provided during

the period, compared with the total estimated development and

implementation services to be provided over the entire contract. These

services require that we perform significant, extensive and complex design,

development, modification or implementation of our customers’ systems.

Performance will often extend over long periods, and our right to receive

future payment depends on our future performance in accordance with

the agreement. During 2011 and 2010, we recognized approximately

$320 and $270, respectively, of revenue using the percentage-of-

completion accounting method.

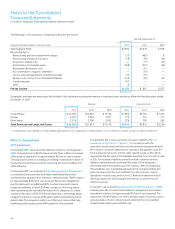

The percentage-of-completion methodology involves recognizing

probable and reasonably estimable revenue using the percentage of

services completed, on a current cumulative cost to estimated total cost

basis, using a reasonably consistent profit margin over the period. Due

to the long-term nature of these projects, developing the estimates of

costs often requires significant judgment. Factors that must be considered

in estimating the progress of work completed and ultimate cost of the

projects include, but are not limited to, the availability of labor and labor

productivity, the nature and complexity of the work to be performed

and the impact of delayed performance. If changes occur in delivery,

productivity or other factors used in developing the estimates of costs

or revenues, we revise our cost and revenue estimates, which may result

in increases or decreases in revenues and costs, and such revisions are

reflected in income in the period in which the facts that give rise to that

revision become known.

Revenues earned in excess of related billings are accrued, whereas

billings in excess of revenues earned are deferred until the related

services are provided. We recognize revenues for non-refundable, upfront

implementation fees on a straight-line basis over the period between the

initiation of the ongoing services through the end of the contract term.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)