Xerox 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65Xerox 2011 Annual Report

Impairment testing for goodwill is done at the reporting unit level. A

reporting unit is an operating segment or one level below an operating

segment (a “component”) if the component constitutes a business

for which discrete financial information is available, and segment

management regularly reviews the operating results of that component.

As noted previously, in the fourth quarter of 2011, we early-adopted

ASU No. 2011-08, Intangibles – Goodwill and Other (Topic 350) – Testing

Goodwill for Impairment, which allows an entity to use a qualitative

approach to test goodwill for impairment. As a result, in performing

our annual impairment test, we first perform a qualitative assessment

to determine whether it is more likely than not that the fair value of a

reporting unit is less than its carrying value, including allocated goodwill.

If it is concluded that this is the case for one or more reporting units, we

would then perform a detailed quantitative assessment. In 2011, after

completing our annual qualitative reviews for each of our reporting units,

we concluded that it was not more likely than not that the carrying value

of any of our reporting units exceeded its fair value and, therefore, further

quantitative analysis was not required.

Other intangible assets primarily consist of assets obtained in connection

with business acquisitions, including installed customer base and

distribution network relationships, patents on existing technology and

trademarks. We apply an impairment evaluation whenever events or

changes in business circumstances indicate that the carrying value of

our intangible assets may not be recoverable. Other intangible assets

are amortized on a straight-line basis over their estimated economic

lives. We believe that the straight-line method of amortization reflects

an appropriate allocation of the cost of the intangible assets to earnings

in proportion to the amount of economic benefits obtained annually by

the Company. Refer to Note 8 – Goodwill and Intangible Assets, Net for

further information.

ImpairmentofLong-LivedAssets

We review the recoverability of our long-lived assets, including buildings,

equipment, internal use software and other intangible assets, when events

or changes in circumstances occur that indicate that the carrying value of

the asset may not be recoverable. The assessment of possible impairment

is based on our ability to recover the carrying value of the asset from the

expected future pre-tax cash flows (undiscounted and without interest

charges) of the related operations. If these cash flows are less than the

carrying value of such asset, an impairment loss is recognized for the

difference between estimated fair value and carrying value. Our primary

measure of fair value is based on discounted cash flows.

TreasuryStock

We account for repurchased common stock under the cost method and

include such Treasury stock as a component of our Common shareholders’

equity. Retirement of Treasury stock is recorded as a reduction of Common

stock and Additional paid-in capital at the time such retirement is

approved by our Board of Directors.

Land,BuildingsandEquipmentandEquipmentonOperatingLeases

Land, buildings and equipment are recorded at cost. Buildings and

equipment are depreciated over their estimated useful lives. Leasehold

improvements are depreciated over the shorter of the lease term or the

estimated useful life. Equipment on operating leases is depreciated to

estimated salvage value over the lease term. Depreciation is computed

using the straight-line method. Significant improvements are capitalized

and maintenance and repairs are expensed. Refer to Note 5 – Inventories

and Equipment on Operating Leases, Net and Note 6 – Land, Buildings

and Equipment, Net for further discussion.

Software–InternalUseandProduct

We capitalize direct costs associated with developing, purchasing or

otherwise acquiring software for internal use and amortize these costs

on a straight-line basis over the expected useful life of the software,

beginning when the software is implemented (“Internal Use Software”).

Costs incurred for upgrades and enhancements that will not result in

additional functionality are expensed as incurred. Useful lives of Internal

Use Software generally vary from three to 10 years. Amounts expended

for Internal Use Software are included in Cash Flows from Investing.

We also capitalize certain costs related to the development of

software solutions to be sold to our customers upon reaching

technological feasibility and amortize these costs based on estimated

future revenues (“Product Software”). In recognition of the uncertainties

involved in estimating revenue, that amortization is not less than

straight-line amortization over the software’s remaining estimated

economic life. Useful lives of Product Software generally vary from three

to 10 years. Amounts expended for Product Software are included in

Cash Flows from Operations.

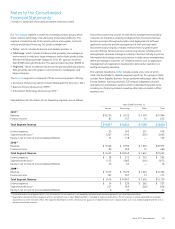

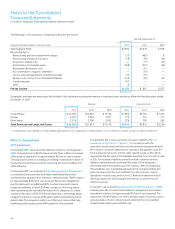

Year Ended December 31,

Additions to: 2011 2010 2009

Internal use software $ 163 $ 164 $ 98

Product software 108 70 1

December 31,

Capitalized costs, net: 2011 2010

Internal use software $ 545 $ 468

Product software 256 145

GoodwillandOtherIntangibleAssets

Goodwill represents the excess of the purchase price over the fair value

of acquired net assets in a business combination, including the amount

assigned to identifiable intangible assets. The primary drivers that

generate goodwill are the value of synergies between the acquired entities

and the company and the acquired assembled workforce, neither of which

qualifies as an identifiable intangible asset. Goodwill is not amortized but

rather is tested for impairment annually or more frequently if an event or

circumstance indicates that an impairment loss may have been incurred.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)