Xerox 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

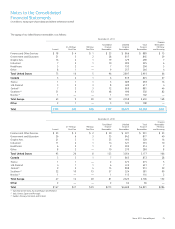

Note 4 – Receivables, Net

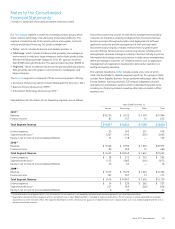

Accounts Receivable

Accounts receivable, net were as follows:

December 31,

2011 2010

Amounts billed or billable $ 2,307 $ 2,491

Unbilled amounts 395 447

Allowance for doubtful accounts (102) (112)

Accounts Receivable, Net $ 2,600 $ 2,826

The allowance for uncollectible accounts receivables is determined

principally on the basis of past collection experience, as well as

consideration of current economic conditions and changes in our

customer collection trends. Unbilled amounts include amounts associated

with percentage-of-completion accounting, and other earned revenues

not currently billable due to contractual provisions. Amounts to be invoiced

in the subsequent month for current services provided are included in

amounts billable, and at December 31, 2011 and 2010

were approximately $963 and $1,066, respectively.

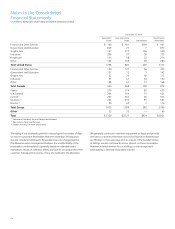

Accounts Receivable Sales Arrangements

We have facilities in the U.S., Canada and several countries in Europe

that enable us to sell to third parties, on an ongoing basis, certain

accounts receivable without recourse. The accounts receivables sold

are generally short-term trade receivables with payment due dates of

less than 60 days. The agreements involve the sale of entire groups

of accounts receivable for cash. In certain instances a portion of the

sales proceeds are held back by the purchaser and payment is deferred

until collection of the related receivables sold. Such holdbacks are not

considered legal securities nor are they certificated. We report collections

on such receivables as operating cash flows in the Consolidated

Statements of Cash Flows, because such receivables are the result of an

operating activity and the associated interest rate risk is de minimis due

to their short-term nature. These receivables are included in the caption

“Other current assets” in the accompanying Consolidated Balance Sheets

and were $97 and $90 at December 31, 2011 and December 31, 2010,

respectively. Of the accounts receivables sold and derecognized from our

Balance Sheet, $815 and $684 remained uncollected as of December

31, 2011 and 2010, respectively.

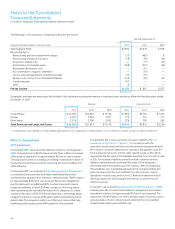

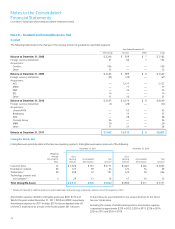

The transaction was accounted for using the acquisition method of

accounting which requires, among other things, that most assets acquired

and liabilities assumed are recognized at their fair values as of the

acquisition date. The following table summarizes the assets acquired

and liabilities assumed as of the acquisition date:

February 5, 2010

Assets

Cash and cash equivalents $ 351

Accounts receivable 1,344

Other current assets 389

Land, buildings and equipment 416

Intangible assets 3,035

Goodwill 5,127

Other long-term assets 258

Liabilities

Other current liabilities 645

Deferred revenue 161

Deferred tax liability 990

Debt 2,310

Pension liabilities 39

Other long-term liabilities 263

Net Assets Acquired $ 6,512

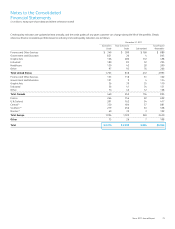

The unaudited pro-forma results presented below include the effects

of the ACS acquisition as if it had been consummated as of January 1,

2010. The pro-forma results include the amortization associated with the

acquired intangible assets and interest expense associated with debt used

to fund the acquisition, as well as fair value adjustments for unearned

revenue, software and land, buildings and equipment. To better reflect

the combined operating results, material non-recurring charges directly

attributable to the transaction have been excluded. In addition, the

pro-forma results do not include any synergies or other benefits of the

acquisition. Accordingly, the unaudited pro-forma financial information

below is not necessarily indicative of either future results of operations

or results that might have been achieved had the acquisition been

consummated as of January 1, 2010.

Year Ended December 31, 2010

Pro-forma As Reported

Revenue $22,252 $21,633

Net income – Xerox 592 606

Basic earnings per share 0.41 0.44

Diluted earnings per share 0.41 0.43

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)