Xerox 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

Note 21 – Subsequent Events

Debt Exchange

In February 2012, we completed an exchange of our 5.71% Zero

Coupon Notes due 2023 with an accreted book value at the date of

the exchange of $303, for approximately $363 of our 4.50% Senior

Notes due 2021. Accordingly, this increased the principal amount for our

4.50% Senior Notes due 2021 from $700 to $1,063. The exchange was

conducted to retire high-interest, long-dated debt in a favorable interest

rate environment. The debt exchange was accounted for as a non-

revolving debt modification and, therefore, it did not result in any gain or

loss. The difference between the book value of our Zero Coupon Notes

and the principal value of the Senior Notes issued in exchange will be

accreted over the remaining term of the Senior Notes. Upfront fees paid

to third parties in relation to the exchange were not material and were

expensed as incurred.

In February 2012, we acquired RK Dixon, a leading provider of IT

services, copiers, printers and managed print services, for approximately

$58. The acquisition furthers our coverage of Central Illinois and Eastern

Iowa, building on our strategy to create a nationwide network of locally

based companies focused on customers’ needs to improve business

performance through efficiencies. We are in the process of determining

the purchase price allocation.

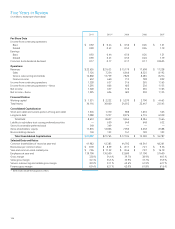

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)