Xerox 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91Xerox 2011 Annual Report

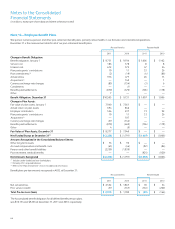

The following table represents a rollforward of the defined benefit plans assets measured using significant unobservable inputs (Level 3 assets):

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

Private Guaranteed

Equity/Venture Insurance

Real Estate Capital Contracts Hedge Funds Other Total

December 31, 2009 $ 237 $ 286 $ 130 $ 4 $ — $ 657

Purchases 41 30 1 — — 72

Sales (34) (38) (13) — — (85)

Net transfers in from Level 1 — — 1 — — 1

Realized gains (losses) 5 28 (2) — — 31

Unrealized gains (losses) 22 — (2) — — 20

Currency translation (6) — (9) — — (15)

Other 10 1 (9) — (1) 1

December 31, 2010 275 307 97 4 (1) 682

Purchases 69 30 3 — — 102

Sales (6) (61) (3) (1) — (71)

Net transfers in from Level 1 2 — 12 — — 14

Net transfers in from Level 2 — — 9 — — 9

Realized gains (losses) — 46 (1) — — 45

Unrealized gains (losses) 18 (4) (4) — — 10

Currency translation (4) — (3) — — (7)

Other (2) — 6 — 1 5

December 31, 2011 $ 352 $ 318 $ 116 $ 3 $ — $ 789

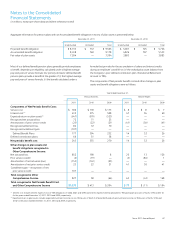

Our pension plan assets and benefit obligations at December 31, 2011

were as follows:

Fair Value Pension Net

of Pension Benefit Funded

(in billions) Plan Assets Obligations Status

U.S. funded $ 3.3 $ 4.3 $ (1.0)

U.S. unfunded — 0.3 (0.3)

Total U.S. $ 3.3 $ 4.6 $ (1.3)

U.K. 3.0 3.3 (0.3)

Canada 0.6 0.8 (0.2)

Other funded 1.4 1.3 0.1

Other unfunded — 0.5 (0.5)

Total $ 8.3 $ 10.5 $ (2.2)

InvestmentStrategy

The target asset allocations for our worldwide plans were:

2011 2010

Equity investments 41% 42%

Fixed-income investments 45% 45%

Real estate 7% 7%

Private equity 4% 4%

Other 3% 2%

Total Investment Strategy

100% 100%

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)