Xerox 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69Xerox 2011 Annual Report

In February 2009, we acquired ComDoc,Inc. for approximately $145 in

cash. ComDoc is one of the largest independent office technology dealers

in the U.S. and it expanded our coverage in Ohio, Pennsylvania, New York

and West Virginia.

Our Technology segment also acquired one additional business in both

2010 and 2009 for $21 and $18 in cash, respectively, as part of our

strategy of increasing our U.S. distribution network for small and midsize

businesses. Our Services segment acquired one additional business in

2010 for $12 in cash.

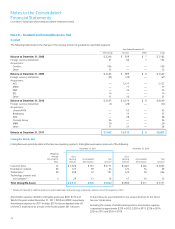

Summary – 2010 and 2009 Acquisitions

The operating results of the 2010 and 2009 acquisitions described above

were not material to our financial statements and were included within our

results from the respective acquisition dates. TMS and EHRO were included

within our Services segment, while the acquisition of IBS and ComDoc

were primarily included within our Technology segment. The purchase

prices were primarily allocated to intangible assets and goodwill based

on third-party valuations and management’s estimates. Refer to Note 8 –

Goodwill and Intangible Assets, Net for additional information. Excluding

ACS, our 2010 acquisitions contributed aggregate revenues from their

respective acquisition dates of approximately $318 and $140 to our 2011

and 2010 total revenues, respectively.

Contingent Consideration

In connection with certain acquisitions, we are obligated to make

contingent payments if specified contractual performance targets are

achieved. Contingent consideration obligations are recorded at their

respective fair value. As of December 31, 2011, the maximum aggregate

amount of outstanding contingent obligations to former owners of

acquired entities was approximately $42, of which $27 was accrued,

representing the estimated fair value of this obligation. We made

contingent payments of $2 and $8 in 2011 and 2010, respectively,

which are reflected within investing activities in the Consolidated

Statements of Cash Flows.

Affiliated Computer Services, Inc. (“ACS”)

In February 2010, we acquired ACS in a cash-and-stock transaction valued

at approximately $6.5 billion. Each outstanding share of ACS common

stock was converted into a combination of 4.935 shares of Xerox common

stock and $18.60 in cash. In addition, as of the acquisition date, we repaid

$1.7 billion of ACS’s debt and assumed an additional $0.6 billion of debt.

We also issued convertible preferred stock with a fair value of $349 and

stock options valued at $222 (Refer to Note 17 – Preferred Stock and

Note 18 – Shareholders’ Equity for additional information regarding the

issuance of preferred stock and stock options, respectively). ACS provides

business process outsourcing and information technology outsourcing

services and solutions to commercial and governmental clients worldwide.

The operating results of ACS are included in our Services segment from

February 6, 2010.

In April 2011, we acquired Unamic/HCNB.V., the largest privately

owned customer care provider in the Benelux region in Western Europe,

for approximately $55 net of cash acquired. Unamic/HCN’s focus on the

Dutch-speaking market expands our customer care capabilities in the

Netherlands, Belgium, Turkey and Suriname.

In February 2011, we acquired ConceptGroup,Ltd. for $41 net of cash

acquired. This acquisition expands our reach into the small and midsize

business market in the U.K. Concept Group has nine locations throughout

the U.K. and provides document imaging solutions and technical services

to more than 3,000 customers.

Our Technology segment also acquired seven additional businesses

in 2011 for a total of $21 in cash as part of our strategy of increasing

our U.S. distribution network primarily for small and midsize businesses.

Our Services segment acquired three additional businesses in 2011

for a total of $25 in cash, primarily related to software to support our

BPO service offerings.

2011 Summary

The operating results of the acquisitions described above are not material

to our financial statements and are included within our results from the

respective acquisition dates. Breakaway, Symcor, ESM and Unamic/

HCN are included within our Services segment, while the acquisitions of

MBM and Concept Group are included within our Technology segment.

The purchase prices for all acquisitions, except Symcor, were primarily

allocated to intangible assets and goodwill based on third-party valuation

and management’s estimates. Refer to Note 8 – Goodwill and Intangible

Assets, Net for additional information. The overall weighted-average life

of the identified amortizable intangible assets is 10 years, which is being

amortized using a weighted average straight-line methodology. Our 2011

acquisitions contributed aggregate revenues of approximately $177 to

our 2011 total revenues from their respective acquisition dates.

2010 and 2009 Acquisitions

In October 2010, we acquired TMSHealth,LLC(“TMS”), a U.S. based

teleservices company that provides customer care services to the

pharmaceutical, biotech and healthcare industries, for approximately

$48 in cash. TMS enables us to improve communications among

pharmaceutical companies, physicians, consumers and pharmacists. By

providing customer education, product sales and marketing and clinical

trial solutions, we augment the IT and BPO services we deliver to the

healthcare and pharmaceutical industries.

In July 2010, we acquired ExcellerateHRO,LLP(“EHRO”), a global benefits

administration and relocation services provider, for $125 net of cash

acquired. EHRO established us as one of the world’s largest pension plan

administrators and as a leading provider of outsourced health and welfare

and relocation services.

In January 2010, we acquired IrishBusinessSystemsLimited(“IBS”),

a managed print services provider, for approximately $29 net of cash

acquired. IBS expanded our reach into the small and midsize business

market in Ireland, where it is the largest independent supplier of digital

imaging and printing solutions.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)