Xerox 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

In connection with the acquisition of ACS in February 2010 (see

Note 3 – Acquisitions for additional information), we issued 489,802

thousand shares of common stock to holders of ACS Class A and

Class B common stock.

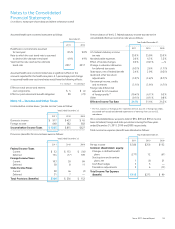

TreasuryStock

The following provides cumulative information relating to our share

repurchase programs from their inception in October 2005 through

December 31, 2011 (shares in thousands):

Authorized share repurchase programs $ 4,500

Share repurchase cost $ 3,641

Share repurchase fees $ 6

Number of shares repurchased 282,036

In January 2012, the Board of Directors authorized an additional $500

million in share repurchase, bringing the total authorization to $5 billion.

The following table reflects the changes in Common and Treasury stock

shares (shares in thousand):

Common Treasury

Stock Stock

Shares Shares

Balance at December 31, 2008 864,777 —

Stock-based compensation plans, net 4,604 —

Balance at December 31, 2009 869,381 —

Stock-based compensation plans, net 37,018 —

ACS acquisition(1) 489,802 —

Other 1,377 —

Balance at December 31, 2010 1,397,578 —

Stock-based compensation plans, net 11,027 —

Contributions to U.S. pension plan(2) 16,645 —

Acquisition of Treasury stock — 87,943

Cancellation of Treasury stock (72,435) (72,435)

Other 34 —

Balance at December 31, 2011

1,352,849 15,508

(1) Refer to Note 3 – Acquisitions for additional information.

(2) Refer to Note 14 – Employee Benefits Plans for additional information.

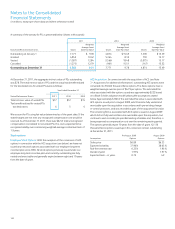

Note 17 – Preferred Stock

SeriesAConvertiblePreferredStock

In connection with the acquisition of ACS in February 2010 (see Note

3 – Acquisitions for additional information), we issued 300,000 shares

of Series A convertible perpetual preferred stock with an aggregate

liquidation preference of $300 and a fair value of $349 as of the

acquisition date to the holder of ACS Class B common stock. The

convertible preferred stock pays quarterly cash dividends at a rate of

8% per year and has a liquidation preference of $1,000 per share.

Each share of convertible preferred stock is convertible at any time, at

the option of the holder, into 89.8876 shares of common stock for a

total of 26,966 thousand shares (reflecting an initial conversion price

of approximately $11.125 per share of common stock which is a 25%

premium over $8.90, the average closing price of Xerox common stock

over the seven-trading day period ended on September 14, 2009 and

the number used for calculating the conversion price in the ACS merger

agreement), subject to customary anti-dilution adjustments. On or after

the fifth anniversary of the issue date, we have the right to cause, under

certain circumstances, any or all of the convertible preferred stock to be

converted into shares of common stock at the then applicable conversion

rate. The convertible preferred stock is also convertible, at the option of

the holder, upon a change in control, at the applicable conversion rate plus

an additional number of shares determined by reference to the price paid

for our common stock upon such change in control. In addition, upon the

occurrence of certain fundamental change events, including a change in

control or the delisting of Xerox’s common stock, the holder of convertible

preferred stock has the right to require us to redeem any or all of the

convertible preferred stock in cash at a redemption price per share equal

to the liquidation preference and any accrued and unpaid dividends to,

but not including, the redemption date. The convertible preferred stock

is classified as temporary equity (i.e., apart from permanent equity) as a

result of the contingent redemption feature.

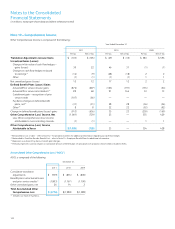

Note 18 – Shareholders’ Equity

PreferredStock

As of December 31, 2011, we had one class of preferred stock outstanding.

See Note 17 – Preferred Stock for further information. We are authorized

to issue approximately 22 million shares of cumulative preferred stock,

$1.00 par value per share.

CommonStock

We have 1.75 billion authorized shares of common stock, $1.00 par value

per share. At December 31, 2011, 150 million shares were reserved for

issuance under our incentive compensation plans, 48 million shares were

reserved for debt to equity exchanges, 27 million shares were reserved

for conversion of the Series A convertible preferred stock and two million

shares were reserved for the conversion of convertible debt.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)