Xerox 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

35Xerox 2011 Annual Report

– Supplies, paper and other sales of $3,377 million increased 9%,

or 4% on a pro-forma(1) basis, with a 1-percentage point negative

impact from currency. Growth in supplies revenues was partially

offset by a decline in paper sales.

•Equipment sales revenue increased 9% and included a 1-percentage

point negative impact from currency. Growth in install activity was

partially offset by price declines of approximately 5% and mix.

•8% increase in color(2) revenue, including a 1-percentage point

negative impact from currency reflecting:

– 5% increase in color(2) annuity revenue, including a 1-percentage

point negative impact from currency. The increase was driven by

higher printer supplies sales and higher page volumes.

– 12% increase in color(2) equipment sales revenue, including a

2-percentage point negative impact from currency. The increase was

driven by higher installs of new products.

– 9% growth in color pages(2) representing 23% of total pages in

2010, while color device MIF represented 31% of total MIF.

An analysis of the change in revenue for each business segment

is included in the “Operations Review of Segment Revenue and

Profit” section.

Refer to the “Non-GAAP Financial Measures” section for a further

explanation and discussion of this non-GAAP presentation.

Gross Margin

Gross margin for year ended December 31, 2011 of 32.8% decreased

1.6-percentage points, or 1.1-percentage points on a pro-forma(1) basis,

as compared to 2010. The decrease was driven by the ramping of new

services contracts, the impact of lower contract renewals, transaction

currency and the mix of higher services revenue.

Gross margin for year ended December 31, 2010 of 34.4% decreased

5.3-percentage points, or 0.2-percentage points on a pro-forma(1) basis,

as compared to 2009. The decrease is primarily due to the unfavorable

impact of year-over-year transaction currency.

Services gross margin for the year ended December 31, 2011 decreased

1.7-percentage points, or 1.2-percentage points on a pro-forma(1) basis,

as compared to 2010. The decrease is primarily due to the ramping

of new services contracts within BPO and ITO and the impact of lower

contract renewals.

Revenue2010

Total revenues increased 43% compared to the prior year. Our

consolidated 2010 results include ACS results subsequent to February 5,

2010, the effective date of the acquisition. On a pro-forma(1) basis, total

revenue for 2010 grew 3%. Currency had a negligible impact on total

revenues during 2010. Total revenues included the following:

•Annuity revenue increased 53%, or 1% on a pro-forma(1) basis, with a

1-percentage point negative impact from currency. The components

of annuity revenue were as follows:

– Service, outsourcing and rentals revenue of $13,739 million

increased 76%, or 1% on a pro-forma(1) basis, and included a

negligible impact from currency. The increase was driven by BPO

revenue that partially offset the declines in technical service revenue

which were driven by a continued but stabilizing decline in pages.

Total digital pages declined 4% while color pages increased 9%.

During 2010 digital MIF increased by 1% and color MIF increased

by 15%.

Operating Margin

The operating margin(3) for the year ended December 31, 2011 of 9.8%

increased 0.2-percentage points, or 0.3-percentage points on a pro-

forma(1) basis, as compared to 2010. The increase was due primarily to

disciplined cost and expense management.

The operating margin(3) for the year ended December 31, 2010 of 9.6%

increased 2.8-percentage points, or 1.0-percentage points on a pro-

forma(1) basis, as compared to 2009. The improvement reflects strong

revenue growth and continued disciplined cost and expense management.

Note: The acquisition of ACS increased the proportion of our revenue from

services, which has a lower gross margin and SAG as a percent of revenue

than we historically experienced when Xerox was primarily a technology

company. As a result, gross margins and SAG are also discussed below on a

pro-forma basis. In 2011, for comparison purposes, we adjust our historical

2010 results to include ACS’s 2010 estimated results for the period from

January 1 through February 5, 2010. In 2010, for comparison purposes, we

adjust our historical 2009 results to include ACS’s 2009 estimated results

for the period from February 6 through December 31, 2009. We believe

these pro-forma comparisons provide a perspective on the impact of the

ACS acquisition on our results and trends.

Costs, Expenses and Other Income

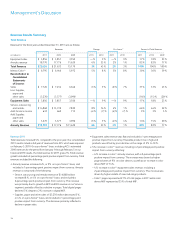

Summary of Key Financial Ratios

Year Ended December 31, Change Pro-forma(1)

2011 2010 2009 2011 2010 2011 2010

Total Gross Margin 32.8% 34.4% 39.7% (1.6) pts (5.3) pts (1.1) pts (0.2) pts

RD&E as a % of Revenue 3.2% 3.6% 5.5% (0.4) pts (1.9) pts (0.3) pts (0.4) pts

SAG as a % of Revenue 19.9% 21.2% 27.3% (1.3) pts (6.1) pts (1.0) pts (0.9) pts

Operating Margin(3) 9.8% 9.6% 6.8% 0.2 pts 2.8 pts 0.3 pts 1.0 pts

Pre-tax Income Margin 6.9% 3.8% 4.1% 3.1 pts (0.3) pts 3.4 pts (2.2) pts