Xerox 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion

37Xerox 2011 Annual Report

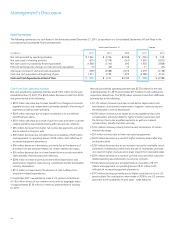

During the year ended December 31, 2010, we recorded $483 million

of net restructuring and asset impairment charges, which included

the following:

•$470 million of severance costs related to headcount reductions of

approximately 9,000 employees. The costs associated with these

actions applied about equally to North America and Europe, with

approximately 20% related to our developing market countries.

Approximately 50% of the costs were focused on gross margin

improvements, 40% on SAG and 10% on the optimization of RD&E

investments and impacted the following functional areas:

– Services

– Supply chain and manufacturing

– Back-office administration

– Development and engineering.

•$28 million for lease termination costs primarily reflecting the

continued rationalization and optimization of our worldwide operating

locations, including consolidations with ACS.

•$19 million loss associated with the sale of our Venezuelan subsidiary.

The loss primarily reflects the write-off our Venezuelan net assets

including working capital and long-lived assets. We continue to sell

equipment, parts and supplies to the acquiring company through

a distribution arrangement but no longer have any direct or local

operations in Venezuela.

•The above charges were partially offset by $41 million of net reversals

for changes in estimated reserves from prior-period initiatives.

Restructuring Summary

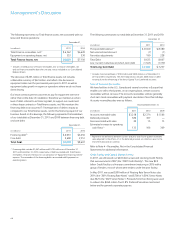

The restructuring reserve balance as of December 31, 2011 for all

programs was $123 million, of which approximately $116 million

is expected to be spent over the next 12 months. Refer to Note 9 –

Restructuring and Asset Impairment Charges in the Consolidated

Financial Statements for additional information regarding our

restructuring programs.

Acquisition-Related Costs

Costs of $77 million were incurred during 2010 in connection with

our acquisition of ACS. These costs include $53 million of transaction

costs, which represent external costs directly related to completing

the acquisition of ACS. The remainder of the acquisition-related costs

represents external incremental costs directly related to the integration of

ACS and Xerox.

Costs of $72 million were incurred during 2009 in connection with our

acquisition of ACS. $58 million of the costs relate to the write-off of fees

associated with a Bridge Loan Facility commitment which was terminated

as a result of securing permanent financing to fund the acquisition. The

remainder of the costs represent transaction costs such as banking, legal

and accounting fees, as well as some pre-integration costs such as external

consulting services.

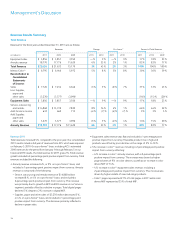

SAG expenses of $4,594 million for the year ended December 31, 2010

were $445 million higher than 2009, or $57 million lower on a pro-forma(1)

basis, including a negligible impact from currency. The pro-forma SAG

decrease reflects the following:

•$137 million increase in selling expenses, reflecting increased demand

generation and brand advertising and higher commissions, partially

offset by restructuring savings and productivity improvements

•$86 million decrease in general and administrative expenses, reflecting

benefits from restructuring and operational improvements

•$108 million decrease in bad debt expense, to $188 million, reflecting

an improved write-off trend.

Restructuring and Asset Impairment Charges

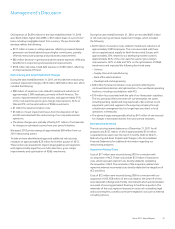

During the year ended December 31, 2011, we recorded net restructuring

and asset impairment charges of $33 million ($18 million after-tax), which

included the following:

•$98 million of severance costs related to headcount reductions of

approximately 3,900 employees, primarily in North America. The

actions impacted several functional areas, and approximately 55%

of the costs were focused on gross margin improvements, 36% on

SAG and 9% on the optimization of RD&E investments.

•$1 million for lease termination costs.

•$5 million of asset impairment losses from the disposition of two

aircraft associated with the restructuring of our corporate aviation

operations.

•The above charges were partially offset by $71 million of net reversals

for changes in estimated reserves from prior period initiatives.

We expect 2012 pre-tax savings of approximately $60 million from our

2011 restructuring actions.

To date we have identified and approved additional restructuring

initiatives of approximately $25 million for the first quarter of 2012.

These actions are expected to impact all geographies and segments,

with approximately equal focus on SAG reductions, gross margin

improvements and optimization of RD&E investments.