Xerox 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

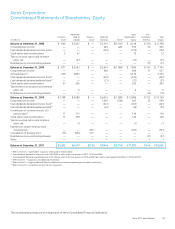

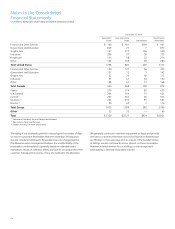

The following is a reconciliation of segment profit to pre-tax income:

Year Ended December 31,

Segment Profit Reconciliation to Pre-tax Income 2011 2010 2009

Total Segment Profit $ 2,092 $ 1,875 $ 838

Reconciling items:

Restructuring and asset impairment charges (33) (483) 8

Restructuring charges of Fuji Xerox (19) (38) (46)

Acquisition-related costs — (77) (72)

Amortization of intangible assets (398) (312) (60)

Venezuelan devaluation costs — (21) —

ACS shareholders’ litigation settlement — (36) —

Loss on early extinguishment of liability and debt (33) (15) —

Equity in net income of unconsolidated affiliates (149) (78) (41)

Curtailment gain 107 — —

Other (2) — —

Pre-tax Income $ 1,565 $ 815 $ 627

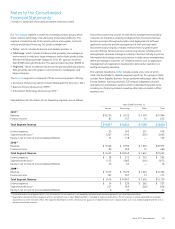

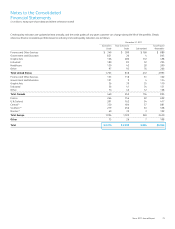

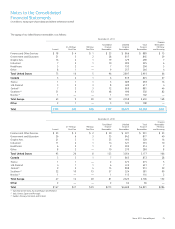

Geographic area data are based upon the location of the subsidiary reporting the revenue or long-lived assets and are as follows for the three years ended

December 31, 2011:

Revenues Long-Lived Assets (1)

2011 2010 2009 2011 2010 2009

United States $ 14,493 $ 13,801 $ 8,156 $ 1,894 $ 1,764 $ 1,245

Europe 5,557 5,332 4,971 776 741 717

Other areas 2,576 2,500 2,052 276 309 262

Total Revenues and Long-Lived Assets $ 22,626 $ 21,633 $ 15,179 $ 2,946 $ 2,814 $ 2,224

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use software, net and (iv) product software, net.

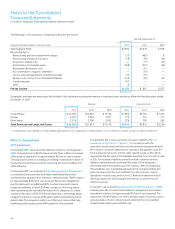

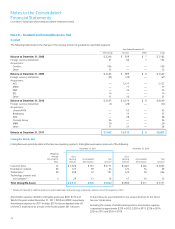

In September 2011, we acquired the net assets related to the U.S.

operationsofSymcorInc.(“Symcor”). In connection with the

acquisition, we assumed and took over the operational responsibility for

the customer contracts related to this operation. We agreed to pay $17

for the acquired net assets and the seller agreed to pay us $52, which

represented the fair value of the liabilities assumed, for a net cash receipt

of $35. The assumed liabilities primarily include customer contract

liabilities representing the estimated fair value of the obligations

associated with the assumed customer contracts. We are recognizing

these liabilities over a weighted-average period of approximately two

years consistent with the cash outflows from the contracts. Symcor

specializes in outsourcing services for U.S. financial institutions and its

offerings range from cash management services to statement and

check processing.

In July 2011, we acquired EducationSalesandMarketing,LLC(“ESM”),

a leading provider of outsourced enrollment management and student

loan default solutions, for approximately $43 net of cash acquired. The

acquisition of ESM enables us to offer a broader range of services to assist

post-secondary schools in attracting and retaining the most qualified

students while reducing accreditation risk.

Note 3 – Acquisitions

2011 Acquisitions

In December 2011, we acquired the Merizon Group Inc. which operates

MBM, formerly known as Modern Business Machines, a Wisconsin-based

office products distributor, for approximately $42 net of cash acquired.

The acquisition furthers our strategy of creating a nationwide network of

locally based companies focused on improving document workflow and

office efficiency.

In November 2011, we acquired TheBreakawayGroup(“Breakaway”),

a cloud-based service provider that helps healthcare professionals

accelerate their adoption of an electronic medical records (“EMR”) system,

for approximately $18 net of cash acquired. We are also obligated to

pay the sellers up to an additional $25 if certain future performance

targets are achieved, of which $18 was recorded as of the acquisition

date representing the estimated fair value of this obligation, for a total

acquisition fair value of $36. The Denver-based firm’s technology allows

caregivers to practice using an EMR system without jeopardizing actual

patient data. This acquisition adds to our offering of services that help

healthcare professionals use the EMR system for clinical benefit.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)