Xerox 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion

50

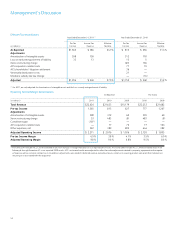

Management believes that these non-GAAP financial measures provide

an additional means of analyzing the current periods’ results against the

corresponding prior periods’ results. However, these non-GAAP financial

measures should be viewed in addition to, and not as a substitute for,

the Company’s reported results prepared in accordance with GAAP. Our

non-GAAP financial measures are not meant to be considered in isolation

or as a substitute for comparable GAAP measures and should be read only

in conjunction with our consolidated financial statements prepared in

accordance with GAAP. Our management regularly uses our supplemental

non-GAAP financial measures internally to understand, manage and

evaluate our business and make operating decisions. These non-GAAP

measures are among the primary factors management uses in planning

for and forecasting future periods. Compensation of our executives is

based in part on the performance of our business based on these non-

GAAP measures.

A reconciliation of these non-GAAP financial measures and the most

directly comparable measures calculated and presented in accordance

with GAAP are set forth on the following tables.

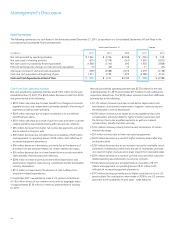

Adjusted Earnings Measures

To better understand the trends in our business and the impact of the

ACS acquisition, we believe it is necessary to adjust the following amounts

determined in accordance with GAAP to exclude the effects of the certain

items as well as their related income tax effects. For our 2011 reporting

year, adjustments were limited to the amortization of intangible assets

and the loss on early extinguishment of liability.

•Net income and Earnings per share (“EPS”),

•Effective tax rate, and

•Pre-tax income(loss) margin.

The above have been adjusted for the following items:

•Amortizationofintangibleassets(allperiods):The amortization

of intangible assets is driven by our acquisition activity which can

vary in size, nature and timing as compared to other companies

within our industry and from period to period. Accordingly, due to

the incomparability of acquisition activity among companies and

from period to period, we believe exclusion of the amortization

associated with intangible assets acquired through our acquisitions

allows investors to better compare and understand our results. The

use of intangible assets contributed to our revenues earned during the

periods presented and will contribute to our future-period revenues as

well. Amortization of intangible assets will recur in future periods.

•Restructuringandassetimpairmentcharges(includingthose

incurredbyFujiXerox)(2010and2009only): Restructuring and asset

impairment charges consist of costs primarily related to severance and

benefits for employees terminated pursuant to formal restructuring

and workforce reduction plans. We exclude these charges because

we believe that these historical costs do not reflect expected future

operating expenses and do not contribute to a meaningful evaluation

of our current or past operating performance. In addition, such

charges are inconsistent in amount and frequency. Such charges

are expected to yield future benefits and savings with respect to our

operational performance.

Financial Risk Management

We are exposed to market risk from foreign currency exchange rates and

interest rates, which could affect operating results, financial position and

cash flows. We manage our exposure to these market risks through our

regular operating and financing activities and, when appropriate, through

the use of derivative financial instruments. We utilized derivative financial

instruments to hedge economic exposures, as well as reduce earnings and

cash flow volatility resulting from shifts in market rates.

Recent market events have not caused us to materially modify or change

our financial risk management strategies with respect to our exposures

to interest rate and foreign currency risk. Refer to Note 12 – Financial

Instruments in the Consolidated Financial Statements for additional

discussion on our financial risk management.

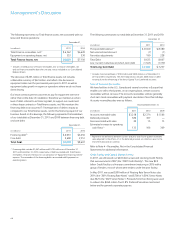

Foreign Exchange Risk Management

Assuming a 10% appreciation or depreciation in foreign currency

exchange rates from the quoted foreign currency exchange rates at

December 31, 2011, the potential change in the fair value of foreign

currency-denominated assets and liabilities in each entity would

not be significant because all material currency asset and liability

exposures were economically hedged as of December 31, 2011. A 10%

appreciation or depreciation of the U.S. Dollar against all currencies

from the quoted foreign currency exchange rates at December 31, 2011

would have an impact on our cumulative translation adjustment portion

of equity of approximately $740 million. The net amount invested in

foreign subsidiaries and affiliates, primarily Xerox Limited, Fuji Xerox,

Xerox Canada Inc. and Xerox Brasil, and translated into U.S. Dollars

using the year-end exchange rates, was approximately $7.4 billion at

December 31, 2011.

Interest Rate Risk Management

The consolidated weighted-average interest rates related to our total

debt for 2011, 2010 and 2009 approximated 5.2%, 5.8%, and 6.1%,

respectively. Interest expense includes the impact of our interest rate

derivatives.

Virtually all customer-financing assets earn fixed rates of interest.

The interest rates on a significant portion of the Company’s term debt

are fixed.

As of December 31, 2011, $302 million of our total debt carried variable

interest rates, including the effect of pay variable interest rate swaps we

use to reduce the effective interest rate on our fixed coupon debt.

The fair market values of our fixed-rate financial instruments are sensitive

to changes in interest rates. At December 31, 2011, a 10% change

in market interest rates would change the fair values of such financial

instruments by approximately $160 million.

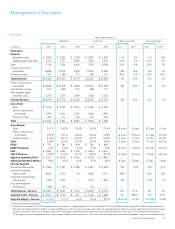

Non-GAAP Financial Measures

We have reported our financial results in accordance with generally

accepted accounting principles (“GAAP”). In addition, we have discussed

our results using non-GAAP measures.