Xerox 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

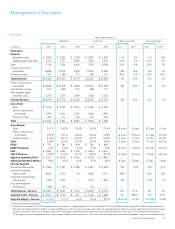

Management’s Discussion

46

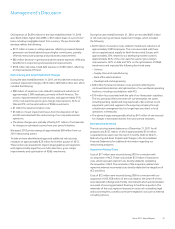

The following represents our Total finance assets, net associated with our

lease and finance operations:

December 31,

(in millions) 2011 2010

Total Finance receivables, net(1) $ 6,362 $ 6,620

Equipment on operating leases, net 533 530

Total Finance Assets, net $ 6,895 $ 7,150

(1) Includes (i) billed portion of finance receivables, net, (ii) finance receivables, net

and (iii) finance receivables due after one year, net as included in our Consolidated

Balance Sheets.

The decrease of $255 million in Total finance assets, net includes

unfavorable currency of $63 million, and reflects the decrease in

equipment sales over the past several years prior to 2011 as well as

equipment sales growth in regions or operations where we do not have

direct leasing.

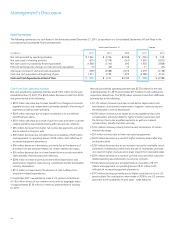

Our lease contracts permit customers to pay for equipment over time

rather than at the date of installation; therefore, we maintain a certain

level of debt, referred to as financing debt, to support our investment

in these lease contracts or Total finance assets, net. We maintain this

financing debt at an assumed 7:1 leverage ratio of debt to equity as

compared to our Total finance assets, net for this financing aspect of our

business. Based on this leverage, the following represents the breakdown

of our total debt at December 31, 2011 and 2010 between financing debt

and core debt:

December 31,

(in millions) 2011 2010

Financing debt(1) $ 6,033 $ 6,256

Core debt 2,600 2,351

Total Debt $ 8,633 $ 8,607

(1) Financing debt includes $5,567 million and $5,793 million as of December 31,

2011 and December 31, 2010, respectively, of debt associated with Total finance

receivables, net and is the basis for our calculation of “Equipment financing interest”

expense. The remainder of the financing debt is associated with Equipment on

operating leases.

The following summarizes our total debt at December 31, 2011 and 2010:

December 31,

(in millions) 2011 2010

Principal debt balance(1) $ 8,450 $ 8,380

Net unamortized discount (7) (1)

Fair value adjustments 190 228

Total Debt 8,633 8,607

Less: Current maturities and short-term debt (1,545) (1,370)

Total Long-Term Debt $ 7,088 $ 7,237

(1) Includes Commercial Paper of $100 million and $300 million as of December 31,

2011 and 2010, respectively. The 2011 balance also includes $650 million in debt

resulting from the refinancing of the Xerox Capital Trust I preferred securities.

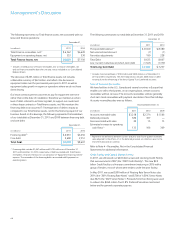

SalesofAccountsReceivable

We have facilities in the U.S., Canada and several countries in Europe that

enable us to sell to third parties, on an ongoing basis, certain accounts

receivables without recourse. The accounts receivables sold are generally

short-term trade receivables with payment due dates of less than 60 days.

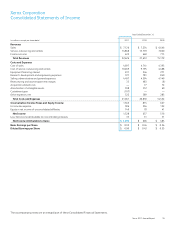

Accounts receivables sales were as follows:

Year Ended December 31,

(in millions) 2011 2010 2009

Accounts receivable sales $ 3,218 $ 2,374 $ 1,566

Deferred proceeds 386 307 —

Fees associated with sales 20 15 13

Estimated increase to operating

cash flows(1) 133 106 309

(1) Represents the difference between current- and prior-year fourth-quarter receivable

sales adjusted for the effects of: (i) the deferred proceeds, (ii) collections prior to the

end of the year and (iii) currency.

Refer to Note 4 – Receivables, Net in the Consolidated Financial

Statements for additional information.

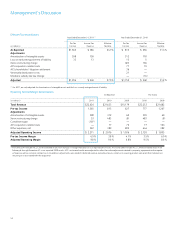

CreditFacilityandCapitalMarketActivity

In 2011, we refinanced our $2.0 billion unsecured revolving Credit Facility

that was executed in 2007 (the “2007 Credit Facility”). This new $2.0

billion Credit Facility is a five-year commitment maturing in 2016 with a

group of lenders, most of whom were lenders under the prior facility.

In May 2011, we issued $300 million of Floating Rate Senior Notes due

2014 (the “2014 Floating Rate Notes”) and $700 of 4.50% Senior Notes

due 2021 (the “2021 Senior Notes”). Proceeds from the offering were used

to redeem the $650 million Trust I 8% Preferred Securities mentioned

below and for general corporate purposes.