Xerox 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders,

The one thing that’s predictable about business is that it’s

fundamentally unpredictable. It’s constantly changing – by chance

and by design. And, macro forces bring new challenges every day.

This was certainly the case in 2011 – a pivotal year of transformation

for our business, and a year when – all said and done – Xerox people

delivered solid financial results, made measured progress, and

continued to build our company into the world’s leading enterprise

for business process and document management. Here is a brief

summary of how we performed:

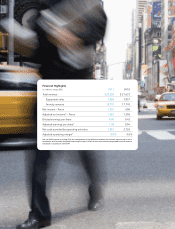

•Wedeliveredadjustedearningspershareof$1.081 – up 15

percent1 over the previous year.

•Totalrevenueforthefullyearwas$22.6billion–uptwopercent

pro-forma.1

•Wegenerated$2billionincashfromoperations.

•Adjustednetincomeof$1.6billion1 was up 21 percent.1

•Weresumedoursharerepurchaseprogramin2011andmade

a sizable investment in it, as well as paying $265 million in

dividends – tangible signs of our commitment to return value

to our shareholders.

Delivering on Commitments

Throughout the year, our business faced challenges stemming from

global economic uncertainty as well as the impact on our supply

chain from the earthquake in Japan. Despite these pressures, I’m

pleased with our 2011 results, but far from satisfied. I’m impatient

by nature and, therefore, very focused on speeding up our progress.

As a company, we’re doing this through the following strategies.

While the statements themselves seem relatively simple, the

complexity is in the detail, and our priorities are clearly centered

on the implementation.

First: Accelerating our services business. We set out to grow

services faster by diversifying our offerings and expanding globally.

More of our total revenue now comes from services than technology.

In 2011, revenue from services grew six percent pro-forma1. And,

through expanded sales activities, we won a considerable amount of

new business – increasing our new business signings by 14 percent.

Letter to Shareholders

Ursula M. Burns

Chairman and Chief Executive Officer

3Xerox 2011 Annual Report