Xerox 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

32

Benefit plan costs are included in several income statement components

based on the related underlying employee costs. Pension and retiree

health benefit plan assumptions are included in Note 14 – Employee

Benefit Plans in the Consolidated Financial Statements.

Income Taxes

We record the estimated future tax effects of temporary differences

between the tax bases of assets and liabilities and amounts reported in

our Consolidated Balance Sheets, as well as operating loss and tax credit

carryforwards. We follow very specific and detailed guidelines in each

tax jurisdiction regarding the recoverability of any tax assets recorded in

our Consolidated Balance Sheets and provide valuation allowances as

required. We regularly review our deferred tax assets for recoverability

considering historical profitability, projected future taxable income, the

expected timing of the reversals of existing temporary differences and

tax planning strategies. If we continue to operate at a loss in certain

jurisdictions or are unable to generate sufficient future taxable income,

or if there is a material change in the actual effective tax rates or time

period within which the underlying temporary differences become taxable

or deductible, we could be required to increase the valuation allowance

against all or a significant portion of our deferred tax assets, resulting

in a substantial increase in our effective tax rate and a material adverse

impact on our operating results. Conversely, if and when our operations

in some jurisdictions become sufficiently profitable to recover previously

reserved deferred tax assets, we would reduce all or a portion of the

applicable valuation allowance in the period when such determination is

made. This would result in an increase to reported earnings in such period.

Adjustments to our valuation allowance, through (credits) charges to

income tax expense, were $(5) million, $22 million and $(11) million for

the years ended December 31, 2011, 2010 and 2009, respectively. There

were other (decreases) increases to our valuation allowance, including

the effects of currency, of $(53) million, $11 million and $55 million for

the years ended December 31, 2011, 2010 and 2009, respectively. These

did not affect income tax expense in total, as there was a corresponding

adjustment to deferred tax assets or other comprehensive income.

Gross deferred tax assets of $3.7 billion and $3.8 billion had valuation

allowances of $677 million and $735 million at December 31, 2011 and

2010, respectively.

We are subject to ongoing tax examinations and assessments in various

jurisdictions. Accordingly, we may incur additional tax expense based upon

our assessment of the more-likely-than-not outcomes of such matters. In

addition, when applicable, we adjust the previously recorded tax expense

to reflect examination results. Our ongoing assessments of the more-likely-

than-not outcomes of the examinations and related tax positions require

judgment and can materially increase or decrease our effective tax rate, as

well as impact our operating results. Unrecognized tax benefits were $225

million, $186 million and $148 million at December 31, 2011, 2010 and

2009, respectively.

and the U.K., which comprise approximately 75% of our projected benefit

obligations, we consider the Moody’s Aa Corporate Bond Index and the

International Index Company’s iBoxx Sterling Corporate AA Cash Bond

Index, respectively, in the determination of the appropriate discount rate

assumptions. The weighted average discount rate we used to measure

our pension obligations as of December 31, 2011 and to calculate our

2012 expense was 4.7%, which is lower than the 5.2% that was used to

calculate our 2011 expense. The weighted average discount rate we used

to measure our retiree health obligation as of December 31, 2011 and to

calculate our 2012 expense was 4.5%, which is lower than the 4.9% that

was used to calculate our 2011 expense.

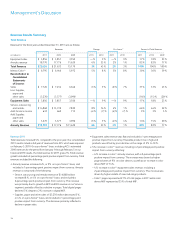

The following is a summary of our benefit plan costs and funding for

the three years ended December 31, 2011, as well as estimated amounts

for 2012:

Estimated Actual

Benefit Plan Costs: 2012 2011 2010 2009

Defined benefit

pension plans(1) $ 321 $ 284 $ 304 $ 232

Curtailment gain(2) — (107) — —

Defined contribution

plans 67 66 51 38

Retiree health

benefit plans 13 14 32 26

Total Benefit

Plan Expense $ 401 $ 257 $ 387 $ 296

(1) Estimated 2012 assumes settlement losses are consistent with 2011.

(2) Refer to the “Plan Amendment” section in Note 14 – Employee Benefit Plans in the

Consolidated Financial Statements for further information.

Our estimated 2012 defined benefit pension plan cost is expected to

be approximately $37 million higher than 2011, primarily driven by

reductions in the discount rate and the corresponding increase in service

cost as well as higher amortization of actuarial losses.

Estimated Actual

Benefit Plan Funding: 2012 2011 2010 2009

Defined benefit

pension plans $ 560 $ 556 $ 237 $ 122

Defined contribution

plans 67 66 51 38

Retiree health

benefit plans 80 73 92 107

Total Benefit

Plan Funding $ 707 $ 695 $ 380 $ 267

Holding all other assumptions constant, a 0.25% increase or decrease in

the discount rate would change the 2012 projected net periodic pension

cost by $28 million. Likewise, a 0.25% increase or decrease in the expected

return on plan assets would change the 2012 projected net periodic

pension cost by $18 million.