Xerox 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71Xerox 2011 Annual Report

Under most of the agreements, we continue to service the sold accounts

receivable. When applicable, a servicing liability is recorded for the

estimated fair value of the servicing. The amounts associated with the

servicing liability were not material. Accounts receivable sales were as

follows:

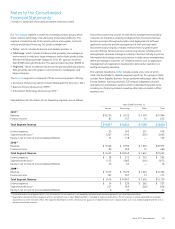

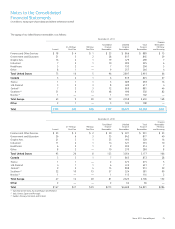

Year Ended December 31,

2011 2010 2009

Accounts receivable sales $ 3,218 $ 2,374 $ 1,566

Deferred proceeds 386 307 —

Fees associated with sales 20 15 13

Estimated increase to operating

cash flows(1) 133 106 309

(1) Represents the difference between current and prior year-end receivable sales

adjusted for the effects of: (i) the deferred proceeds, (ii) collections prior to the end of

the year and (iii) currency.

Finance Receivables

Finance receivables include sales-type leases, direct financing leases

and installment loans arising from the marketing of our equipment.

These receivables are typically collateralized by a security interest in the

underlying assets. Finance receivables, net were as follows:

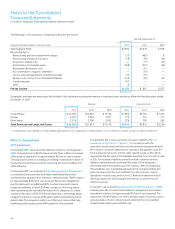

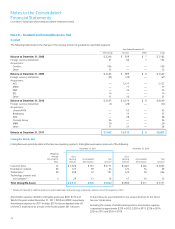

December 31,

2011 2010

Gross receivables $ 7,583 $ 7,914

Unearned income (1,027) (1,093)

Subtotal 6,556 6,821

Residual values 7 11

Allowance for doubtful accounts (201) (212)

Finance receivables, net 6,362 6,620

Less: Billed portion of finance receivables, net 166 198

Less: Current portion of finance receivables

not billed, net 2,165 2,287

Finance Receivables Due After One Year, Net $ 4,031 $ 4,135

Contractual maturities of our gross finance receivables as of December 31,

2011 were as follows (including those already billed of $166):

2012 2013 2014 2015 2016 Thereafter Total

$ 2,832 $2,073 $1,469 $859 $315 $35 $7,583

Our finance receivable portfolios are primarily in the U.S., Canada and

Western Europe. We generally establish customer credit limits and

estimate the allowance for credit losses on a country or geographic

basis. We establish credit limits based upon an initial evaluation of the

customer’s credit quality and adjust that limit accordingly based upon

ongoing credit assessments of the customer, including payment history

and changes in credit quality.

The allowance for doubtful accounts and provision for credit losses

represents an estimate of the losses expected to be incurred from the

Company’s finance receivable portfolio. The level of the allowance is

determined on a collective basis by applying projected loss rates to our

different portfolios by country, which represent our portfolio segments.

This is the level at which we develop and document our methodology

to determine the allowance for credit losses. This loss rate is primarily

based upon historical loss experience adjusted for judgments about the

probable effects of relevant observable data including current economic

conditions as well as delinquency trends, resolution rates, the aging of

receivables, credit quality indicators and the financial health of specific

customer classes or groups. The allowance for doubtful finance receivables

is inherently more difficult to estimate than the allowance for trade

accounts receivable because the underlying lease portfolio has an average

maturity, at any time, of approximately two to three years and contains

past due billed amounts, as well as unbilled amounts. We consider all

available information in our quarterly assessments of the adequacy

of the allowance for doubtful accounts. The identification of account-

specific exposure is not a significant factor in establishing the allowance

for doubtful finance receivables. Our policy and methodology used to

establish our allowance for doubtful accounts have been consistently

applied over all periods presented.

Since our allowance for doubtful finance receivables is determined

by country, the risk characteristics in our finance receivable portfolio

segments will generally be consistent with the risk factors associated with

the economies of those countries/regions. Loss rates declined in both

the U.S. and Canada, reflecting improving economic conditions in those

countries during 2011, and now are more comparable to pre-2008 rates.

Since Europe is comprised of various countries and regional economies,

the risk profile within our European portfolio segment is somewhat more

diversified due to the varying economic conditions among the countries.

However, although charge-offs in Europe were flat in 2011 as compared

to 2010, loss rates increased in 2011 reflecting the economic challenges

currently facing Europe, particularly for those countries in the southern

region. We expect 2012 loss rates to continue to be elevated within Europe

as compared to prior years because of the ongoing economic challenges

in this region.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)