Xerox 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

The objective of using an estimated selling price-based methodology is

to determine the price at which we would transact a sale if the product or

service were sold on a stand-alone basis. Accordingly, we determine our

best estimate of selling price considering multiple factors including, but

not limited to, geographies, market conditions, competitive landscape,

internal costs, gross margin objectives and pricing practices. Estimated

selling price-based methodology generally will apply to an insignificant

proportion of our arrangements with multiple deliverables.

CashandCashEquivalents

Cash and cash equivalents consist of cash on hand, including money-

market funds, and investments with original maturities of three months

or less.

RestrictedCashandInvestments

As more fully discussed in Note 16 – Contingencies and Litigation, various

litigation matters in Brazil require us to make cash deposits to escrow as a

condition of continuing the litigation. In addition, as more fully discussed

in Note 4 – Receivables, Net, we continue to service the receivables sold

under most of our accounts receivable sale agreements. As servicer, we

may collect cash related to sold receivables prior to month-end that will

be remitted to the purchaser the following month. Since we are acting

on behalf of the purchaser in our capacity as servicer, such cash collected

is reported as restricted cash. These cash amounts are classified in our

Consolidated Balance Sheets based on when the cash will be contractually

or judicially released (refer to Note 10 – Supplementary Financial

Information for classification of amounts).

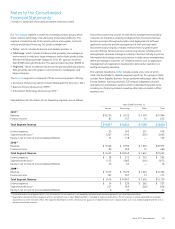

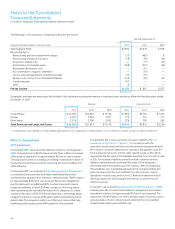

Restricted cash amounts were as follows:

December 31,

2011 2010

Tax and labor litigation deposits in Brazil $ 240 $ 276

Escrow and cash collections related to

receivable sales 88 88

Other restricted cash 15 7

Total Restricted Cash and Investments $ 343 $ 371

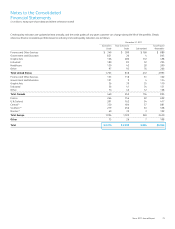

Inventories

Inventories are carried at the lower of average cost or market. Inventories

also include equipment that is returned at the end of the lease term.

Returned equipment is recorded at the lower of remaining net book value

or salvage value. Salvage value consists of the estimated market value

(generally determined based on replacement cost) of the salvageable

component parts, which are expected to be used in the remanufacturing

process. We regularly review inventory quantities and record a provision

for excess and/or obsolete inventory based primarily on our estimated

forecast of product demand, production requirements and servicing

commitments. Several factors may influence the realizability of our

inventories, including our decision to exit a product line, technological

changes and new product development. The provision for excess and/or

obsolete raw materials and equipment inventories is based primarily on

near-term forecasts of product demand and include consideration of new

product introductions, as well as changes in remanufacturing strategies.

The provision for excess and/or obsolete service parts inventory is based

primarily on projected servicing requirements over the life of the related

equipment populations.

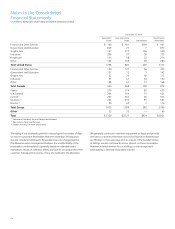

MultipleElementArrangements: We enter into the following revenue

arrangements that may consist of multiple deliverables:

•Bundled lease arrangements, which typically include both lease

deliverables and non-lease deliverables as described above.

•Outright sales of equipment with a related full-service maintenance

agreement.

•Contracts for multiple types of outsourcing services, as well as

professional and value-added services. For instance, we may contract

for an implementation or development project and also provide

services to operate the system over a period of time; or we may

contract to scan, manage and store customer documents.

If a deliverable in a multiple-element arrangement is subject to specific

guidance, such as leased equipment in our bundled lease arrangements

(which is subject to specific leasing guidance) or accessory software (which

is subject to software revenue recognition guidance), that deliverable is

separated from the arrangement based on its relative selling price (the

relative selling price method – see below) and accounted for in accordance

with such specific guidance. The remaining deliverables in a multiple-

element arrangement are accounted for based on the following guidance.

A multiple-element arrangement is separated into more than one unit of

accounting if both of the following criteria are met:

•The delivered item(s) has value to the customer on a stand-alone

basis; and

•If the arrangement includes a general right of return relative to

the delivered item(s), delivery or performance of the undelivered

item(s) is considered probable and substantially in our control. If

these criteria are not met, the arrangement is accounted for as one

unit of accounting and the recognition of revenue is generally upon

delivery/completion or ratably as a single unit of accounting over the

contractual service period.

If these criteria are not met, the arrangement is accounted for as one unit

of accounting which would result in revenue being recognized ratably over

the contract term or being deferred until the earlier of when such criteria

are met or when the last undelivered element is delivered.

Consideration in a multiple-element arrangement is allocated at the

inception of the arrangement to all deliverables on the basis of the relative

selling price. When applying the relative selling price method, the selling

price for each deliverable is determined using VSOE of the selling price.

When VSOE cannot be established, we attempt to establish the selling

price of each deliverable based on third-party evidence (“TPE”). TPE is

determined based on competitor prices for similar deliverables when sold

separately. In substantially all our multiple-element arrangements we

allocate revenue based on VSOE or TPE, since products and services are

generally sold separately or the selling price is determinable based on

competitor prices for similar deliverables. If neither VSOE nor TPE of the

selling price exists for a deliverable, we will use our best estimate of the

selling price for that deliverable.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)