Xerox 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Accelerating

our services business.

Maintaining

our leadership in document technology.

Managing

our business with a disciplined focus on

operational excellence.

Expanding

earnings and returning value to all of you.

Second: Maintaining our leadership in document technology.

We not only continue to hold our number-one equipment revenue

market share position, but we also grew share in 2011. We did this by

offering a more extensive and affordable portfolio of color products

and by expanding our distribution to serve more small and midsize

businesses around the world.

Third: Managing our business with a disciplined focus on

operational excellence. This gives us the financial flexibility to help

offset certain pressures on the business – whether it’s economic

uncertainty or necessary investments that drive growth. Either way

– and despite challenges thrown our way – our focus is on delivering

strong bottom-line results. We’re justifiably proud that we do this

very well.

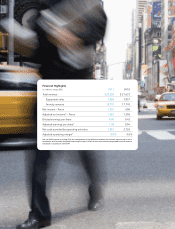

Fourth: The bottom line for Xerox shareholders – expanding

earnings and returning value to all of you. By executing well on

the first three priorities, we delivered on the fourth. Full-year 2011

adjusted earnings per share grew 15 percent1. We generated $2

billion in operating cash flow and repurchased a significant number

of Xerox shares during the year.

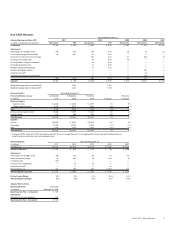

* See non-GAAP measures on page 9 for the reconciliation

of the difference between this financial measure that is

not in compliance with Generally Accepted Accounting

Principles (GAAP) and the most directly comparable

financial measure calculated in accordance with GAAP.

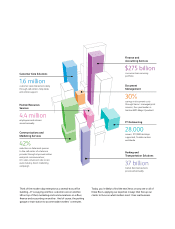

The Services segment now represents the largest

portion of our business.

’07 ’08 ’09 ’10 ’11

1,158*

1,047*

613*

1,296*

1,563*

1,135

230

485

606

1,295

17,228 17,608

15,179

21,633 22,626

’07 ’08 ’09 ’10 ’11

3,749 3,828 3,476

9,637

10,837

22%

22%

23%

45%

48%

’07 ’08 ’09 ’10 ’11

Total Services Segment Revenue

(millions – percent of total revenue)

Total Revenue

(millions)

Net Income – Xerox

(millions)

“Full-year 2011 adjusted earnings per share

grew 15 percent.”

So, good results. And, they’re evidence of a company that is

financially sound, delivering consistent double-digit earnings growth

and applying operational excellence to navigate that unpredictability

most companies face. But, as I mentioned previously, I’m not

satisfied – and I won’t be until we grow revenue faster. In 2011,

revenue was hampered by macro conditions. But, we didn’t let the

headwinds that pressured our top-line performance disrupt our ability

to deliver strong bottom-line results. That said, ratcheting revenue is

a necessity for the sustainable strength of our business. I have great

confidence in our growth potential, and, I can assure you, the Xerox

team is taking a targeted approach to capture the rich opportunity in

front of us.