Xerox 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17Xerox 2011 Annual Report

Investment in R&D is critical for competitiveness in our fast-paced

markets. One of the ways that we maintain our market leadership is

through strategic coordination of our R&D with Fuji Xerox (an equity

investment in which we maintain a 25 percent ownership interest). We

have aligned our R&D investment portfolio with our growth initiatives,

including accelerating our color transition and enhancing customer

value by building on our Services leadership.

Sustaining engineering expenses, which are the hardware engineering

and software development costs we incur after we launch a product,

are included in our RD&E expenses.

RD&E Expenses

(in millions)

R&D

n Sustaining Engineering

Fuji Xerox invested $880

million in R&D in 2011,

$821 million in 2010 and

$796 million in 2009.

Segment Information

Our reportable segments are Services, Technology and Other. We present

operating segment financial information in Note 2 – Segment Reporting

in the Consolidated Financial Statements, which we incorporate by

reference here. We have a very broad and diverse base of customers by

both geography and industry, ranging from small and midsize businesses

(“SMBs”) to graphic communications companies, governmental entities,

educational institutions and Fortune 1000 corporate accounts. None

of our business segments depends upon a single customer, or a few

customers, the loss of which would have a material adverse effect on

our business.

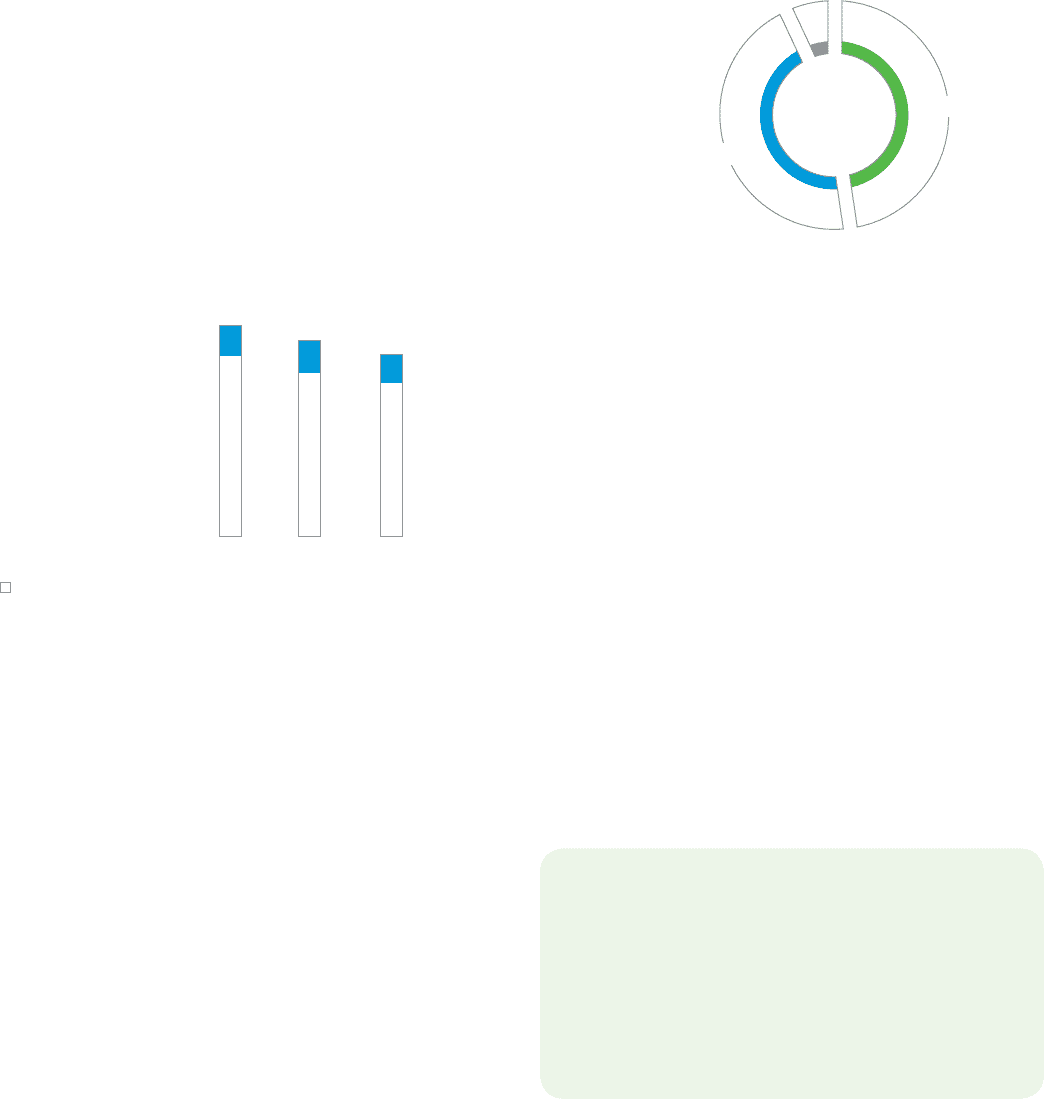

n $10,837 Services

Our Services segment comprises three service offerings: Business

Process Outsourcing (“BPO”), Information Technology Outsourcing

(“ITO”) and Document Outsourcing (“DO”).

n $10,259 Technology

Technology includes the sale of products and supplies,

as well as the associated technical service and financing of those

products.

n $1,530 Other

The Other segment primarily includes revenue from paper sales,

wide-format systems, and GIS network integration solutions and

electronic presentation systems.

Revenues by

Business Segment

(in millions)

$10,837

$10,259

$1,530

Services

Our Services segment comprises three service offerings: Business Process

Outsourcing (“BPO”), Information Technology Outsourcing (“ITO”) and

Document Outsourcing (“DO”). We provide non-core, mission-critical

services that our clients need to run their day-to-day business. The

services help our clients simplify the way work gets done, giving them

more time and resources to allocate to their core operations, respond

rapidly to changing technologies, and reduce expenses associated with

their business processes and information technology support.

The cost and complexities of smoothly

and securely running back-office operations

can be a distraction from focusing on

core business. That’s why enterprises

turn to partners who specialize in key

business processes.

$781

’10

$653

$128

$613

$108

$721

’11

$840

’09

$713

$127