Xerox 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Xerox 2011 Annual Report

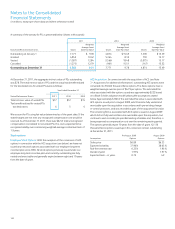

As of December 31, 2011, there was $23 of total unrecognized

compensation cost related to nonvested stock options. This cost is

expected to be recognized ratably over a remaining weighted-average

vesting period of 2.6 years.

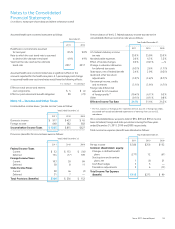

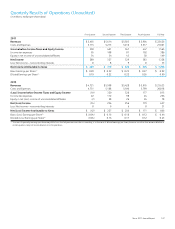

Information relating to options outstanding and exercisable at

December 31, 2011 was as follows:

Options Outstanding Options Exercisable

Aggregate intrinsic value $119 $102

Weighted-average remaining

contractual life in years 4.3 3.5

The following table provides information relating to stock option

exercises:

Year Ended December 31,

2011 2010 2009

Total intrinsic value of

stock options $18 $155 $ —

Cash received 44 183 1

Tax benefit realized for stock

option tax deductions 7 56 —

The following table provides information relating to the status of, and changes in, outstanding stock options (stock options in thousands):

2011 2010 2009

Weighted Weighted Weighted

Stock Average Stock Average Stock Average

Employee Stock Options Options Option Price Options Option Price Options Option Price

Outstanding at January 1 71,038 $8.00 28,363 $10.13 45,185 $15.49

Granted – ACS acquisition — — 96,662 6.79 — —

Canceled/Expired (14,889) 8.38 (2,735) 7.33 (16,676) 24.68

Exercised (6,079) 8.21 (51,252) 6.92 (146) 5.88

Outstanding at December 31 50,070 6.98 71,038 8.00 28,363 10.13

Exercisable at December 31 39,987 7.14 57,985 8.38 28,363 10.13

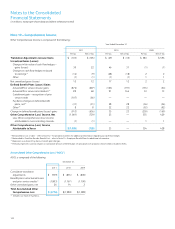

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)