Xerox 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion

29Xerox 2011 Annual Report

In addition, we acquired companies during 2011 that expand our

distribution capacity for Xerox technology to small and midsize businesses

(“SMB”) and in under-penetrated markets:

•In February 2011, we acquired Concept Group, Ltd. This acquisition

expands our reach into the SMB market in the U.K.

•In December 2011, we acquired the Merizon Group Incorporated,

which operates MBM, a Wisconsin-based office products distributor.

We also acquired office product distributors in Iowa, New York, Illinois,

Virginia and Florida.

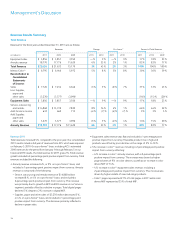

Financial Overview

Total revenue of $22.6 billion in 2011 grew 5% from the prior year,

including a 2-percentage point favorable impact from currency. To provide

a clearer comparison of our year-over-year results, we are also providing

a discussion and analysis on a pro-forma basis for the full year, where we

include ACS’s 2010 estimated results from January 1 through February

5 in our historical 2010 results. On a pro-forma(1) basis, total revenue for

2011 increased 2%, including a 2-percentage point favorable impact

from currency. Total revenue growth was primarily driven by increased

revenues in our Services segment, which grew by 12% in 2011 or 6% on

a pro-forma(1) basis, reflecting strong performance in BPO and DO services.

Technology revenues in 2011 declined 1% from the prior year and

included a 2-percentage point favorable impact from currency. Technology

revenues in 2011 were impacted by macro conditions, including the

natural disaster in Japan in the first quarter and economic weakness in

Europe, particularly in the fourth quarter.

Net income attributable to Xerox for 2011 was $1.3 billion and included

$305 million of after-tax costs and expenses related to the amortization of

intangible assets, restructuring, and the loss on the early extinguishment

of a long-term liability, which were partially offset by an after-tax

curtailment gain of $66 million. Net income attributable to Xerox for

2010 was $606 million and included $690 million of after-tax costs and

expenses related to the amortization of intangible assets, restructuring,

acquisition-related costs and other discrete items. The improvement in

net income reflects continued operational cost savings from restructuring

and productivity improvements that more than offset the impacts from

economic events.

Cash flow from operations was $2.0 billion in 2011 as compared to $2.7

billion in 2010. The decrease reflects increased cash usage in 2011 for

working capital, higher pension contributions and investments associated

with new services contracts. Cash used in investing activities of $675

million primarily reflects capital expenditures of $501 million and

acquisitions of $212 million. Cash used in financing activities was $1.6

billion, which includes the redemption of Xerox Capital Trust’s $650 million

preferred securities, the scheduled repayment of $750 million of Senior

Notes and net payments of $200 million on Commercial Paper, partially

offset by the issuance of $1.0 billion in Senior Notes. Financing activities

also reflect $701 million for the repurchase of common stock and $265

million for dividends.

Total revenue is expected to grow modestly in 2012, reflecting the

mix of continued solid growth in our services business, partially offset

by continued pressure in our technology business, which is impacted

by challenging economic conditions, especially in Europe. The steady

progress we’ve made in increasing signings for our diverse service

offerings positions us well to accelerate revenue growth from Services in

2012. In our Technology business, we expect that Xerox’s competitively

advantaged product portfolio and expanded distribution will drive an

increase in installs of Xerox equipment, maintaining our leadership in

document technology.

We expect to continue our focus on cost management and productivity

improvements. This will help offset the potential impact from unfavorable

currency movements, pension expense and funding requirements, near-

term impact of new Services contracts and economic uncertainty.

Our 2012 balance sheet and cash flow strategy includes: sustaining our

working capital improvements; leveraging of our financing assets (finance

receivables and equipment on operating leases); achieving an optimal

cost of capital; and effectively deploying cash to maximize shareholder

value through share repurchases, acquisitions and dividends.

Europe

As of and for the year ended December 31, 2011, approximately $3.5

billion of our total revenues and $3.3 billion of our total assets are based

in countries where the Euro is the functional currency. Approximately $1.9

billion of those assets are finance receivables and approximately 16%

of those receivables are with governmental entities. Accordingly, we are

impacted by the significant challenges facing the Euro Zone economies

and governments, and we expect those negative impacts to continue in

2012 mainly with respect to revenue growth and bad debt provisions.

Currency Impact

To understand the trends in the business, we believe that it is helpful to

analyze the impact of changes in the translation of foreign currencies

into U.S. Dollars on revenue and expenses. We refer to this analysis

as “currency impact” or “the impact from currency.” This impact is

calculated by translating current-period activity in local currency using

the comparable prior-year period’s currency translation rate. This impact

is calculated for all countries where the functional currency is the local

country currency. Revenues and expenses from our developing market

countries (Latin America, Brazil, the Middle East, India, Eurasia and Central-

Eastern Europe) are analyzed at actual exchange rates for all periods

presented, since these countries generally have unpredictable currency

and inflationary environments, and our operations in these countries have

historically implemented pricing actions to recover the impact of inflation

and devaluation. We do not hedge the translation effect of revenues

or expenses denominated in currencies where the local currency is the

functional currency.