Xerox 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61Xerox 2011 Annual Report

New Accounting Standards and Accounting Changes

Goodwill:

In September 2011, the FASB issued ASUNo.2011-08, Intangibles

– Goodwill and Other (Topic 350) – Testing Goodwill for Impairment,

which allows an entity to use a qualitative approach to test goodwill for

impairment. ASU 2011-08 permits an entity to first perform a qualitative

assessment to determine whether it is more likely than not that the fair

value of a reporting unit is less than its carrying value. If it is concluded

that a potential exposure exists, it is necessary to perform the currently

prescribed two-step goodwill impairment test. Otherwise, the two-step

goodwill impairment test is not required. We adopted ASU 2011-08 in

connection with our annual impairment test performed in the fourth

quarter of 2011. The adoption of this update did not have a material

effect on our financial condition or results of operations.

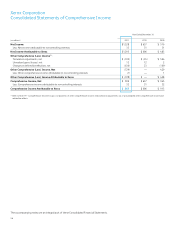

PresentationofComprehensiveIncome:

In June 2011, the FASB issued ASU2011-05, Comprehensive Income

(Topic 220) – Presentation of Comprehensive Income, which requires an

entity to present the total of comprehensive income, the components of

net income, and the components of other comprehensive income either

in a single continuous statement of comprehensive income or in two

separate but consecutive statements. ASU 2011-05 eliminates the option

to present the components of other comprehensive income as part of

the Statement of Shareholders’ Equity. The items that must be reported

in other comprehensive income or when an item of other comprehensive

income must be reclassified to net income were not changed. Additionally,

no changes were made to the calculation and presentation of earnings

per share. In December 2011, the FASB issued ASU 2011-12, which

deferred the effective date of guidance pertaining to the reporting of

reclassification adjustments out of accumulated other comprehensive

income in ASU 2011-05. ASU 2011-12 reinstated the requirements for the

presentation of reclassifications that were in place prior to the issuance

of ASU 2011-05. We adopted ASU 2011-05 effective for our fiscal year

ending December 31, 2011 and have retrospectively applied the new

presentation of comprehensive income to prior periods presented. We

elected to present comprehensive income in two separate but consecutive

statements. Note 19 – Comprehensive Income provides details regarding

the gross components of other comprehensive income, reclassification

adjustments out of accumulated other comprehensive income and the

related tax effects. Other than the change in presentation and disclosure,

the update did not have an impact on our financial condition or results

of operations.

Receivables:

In April 2011, the FASB issued ASU2011-02, to provide additional

guidance on a creditor’s determination of whether a restructuring qualifies

as a troubled debt restructuring. This guidance was provided to assist a

creditor in determining whether it has granted a concession and whether

a debtor is experiencing financial difficulties for purposes of determining

if a restructuring constitutes a troubled debt restructuring. The update

was effective for our third quarter beginning July 1, 2011 and did not

have a material effect on our financial condition, results of operations or

disclosures, as renegotiations and modifications of our finance receivables

only occur on a limited basis and typically do not have a material impact.

FairValueAccounting:

In May 2011, the FASB issued ASU2011-04, which amended Fair

Value Measurements and Disclosures – Overall (ASC Topic 820-10) to

provide a consistent definition of fair value and ensure that the fair value

measurement and disclosure requirements are similar between U.S.

GAAP and International Financial Reporting Standards. ASU 2011-04

changes certain fair value measurement principles and enhances the

disclosure requirements, particularly for Level 3 fair value measurements.

ASU 2011-04 is effective for our fiscal year beginning January 1, 2012

and must be applied prospectively. Early adoption is not permitted. We

do not expect this update to have a material effect on our financial

condition or results of operations.

In 2010, the FASB issued ASUNo.2010-06, which amended Fair Value

Measurements and Disclosures – Overall (ASC Topic 820-10). This update

required a gross presentation of activities within the rollforward of Level

3 measurements and added a new requirement to disclose transfers in

and out of Level 1 and 2 measurements. The update also clarified the

existing disclosure requirements in ASC 820-10 regarding: i) the level

of disaggregation of fair value measurements; and ii) the disclosures

regarding inputs and valuation techniques. This update was effective for

our fiscal year beginning January 1, 2010 except for the gross presentation

of the Level 3 rollforward information, which was effective for our fiscal

year beginning January 1, 2011. The principal impact from this update

was expanded disclosures regarding our fair value measurements.

OtherAccountingChanges:

In December 2011, the FASB issued ASU2011-11, Balance Sheet

(Topic 210), Disclosures about Offsetting Assets and Liabilities. ASU

2011-11 requires entities to disclose both gross information and net

information about both instruments and transactions eligible for offset

in the Balance Sheet and instruments and transactions subject to an

agreement similar to a master netting arrangement to enable users of its

financial statements to understand the effects of offsetting and related

arrangements on its financial position. This update is effective for our fiscal

year beginning January 1, 2013 and must be applied retrospectively. The

principle impact from this update will be to expand disclosures regarding

our financial instruments. We currently report our derivative assets and

liabilities on a gross basis in the Balance Sheet even in those instances

where offsetting may be allowed under a master netting agreement.

In 2009, the FASB issued ASU2009-16, which amended Transfers and

Servicing (ASC Topic 860): Accounting for Transfers of Financial Assets.

This update removed the concept of a qualifying special-purpose entity

and removed the exception from applying consolidation guidance to

these entities. This update also clarified the requirements for isolation

and limitations on portions of financial assets that are eligible for sale

accounting. We adopted this update effective for our fiscal year beginning

January 1, 2010. Certain accounts receivable sale arrangements were

modified in order to qualify for sale accounting under this updated

guidance. The adoption of this update did not have a material effect on

our financial condition or results of operations.

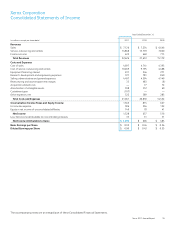

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)