Xerox 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

40

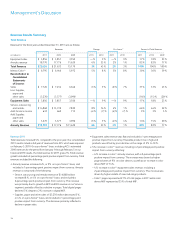

Operations Review of Segment Revenue and Profit

Our reportable segments are consistent with how we manage the business

and view the markets we serve. Our reportable segments are Technology,

Services and Other. Revenues by segment for the three years ended

December 31, 2011 were as follows:

Total Segment Segment

(in millions) Revenue Profit (Loss) Margin

2011

Services $ 10,837 $ 1,207 11.1%

Technology 10,259 1,140 11.1%

Other 1,530 (255) (16.7)%

Total $ 22,626 $ 2,092 9.2%

2010

Services $ 9,637 1,132 11.7%

Technology 10,349 1,085 10.5%

Other 1,647 (342) (20.8)%

Total $ 21,633 $ 1,875 8.7%

2009

Services $ 3,476 $ 231 6.6%

Technology 10,067 949 9.4%

Other 1,636 (342) (20.9)%

Total $ 15,179 $ 838 5.5%

2010 Pro-forma(1)

Services $ 10,256 $ 1,166 11.4%

Technology 10,349 1,085 10.5%

Other 1,647 (353) (21.4)%

Total $ 22,252 $ 1,898 8.5%

2009 Pro-forma(1)

Services $ 9,379 $ 1,008 10.7%

Technology 10,067 949 9.4%

Other 1,636 (447) (27.3)%

Total $ 21,082 $ 1,510 7.2%

Services

Our Services segment comprises three service offerings: Business Process

Outsourcing (“BPO”), Information Technology Outsourcing (“ITO”) and

Document Outsourcing (“DO”). The DO business included within the

Services segment essentially represents Xerox’s pre-ACS acquisition

outsourcing business, as ACS’s outsourcing business is reported as BPO

and ITO revenue.

Equity in Net Income of Unconsolidated Affiliates

Year Ended December 31,

(in millions) 2011 2010 2009

Total equity in net income of

unconsolidated affiliates $ 149 $ 78 $ 41

Fuji Xerox after-tax restructuring

costs 19 38 46

Equity in net income of unconsolidated affiliates primarily reflects our

25% share of Fuji Xerox.

The 2011 increase of $71 million was primarily due to an increase in Fuji

Xerox’s net income, which was primarily driven by higher revenue and

cost improvements, as well as the strengthening of the Yen and lower

restructuring costs.

The 2010 increase of $37 million from 2009 was primarily due to an

increase in Fuji Xerox’s net income, which was primarily driven by higher

revenue and cost improvements, as well as lower restructuring costs.

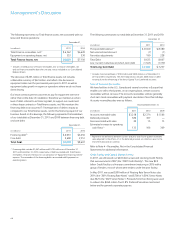

Net Income

Net income attributable to Xerox for the year ended December 31, 2011

was $1,295 million, or $0.90 per diluted share. On an adjusted basis(3),

net income attributable to Xerox was $1,563 million, or $1.08 per diluted

share, and included adjustments for the amortization of intangible assets

and the loss on early extinguishment of liability.

Net income attributable to Xerox for the year ended December 31, 2010

was $606 million, or $0.43 per diluted share. On an adjusted basis(3), net

income attributable to Xerox was $1,296 million, or $0.94 per diluted

share, and included adjustments for the amortization of intangible assets,

restructuring and asset impairment charges (including those incurred by

Fuji Xerox), acquisition-related costs and other discrete costs and expenses.

Refer to the “Non-GAAP Financial Measures” section for the reconciliation

of reported net income to adjusted net income.

Recent Accounting Pronouncements

Refer to Note 1 – Summary of Significant Accounting Policies in the

Consolidated Financial Statements for a description of recent accounting

pronouncements including the respective dates of adoption and the

effects on results of operations and financial conditions.