Xerox 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

be bankruptcy remote and have received opinions to that

effect from outside legal counsel. As a result, the

transferred receivables are not available to satisfy any of

our other obligations. The final funding date for the U.S.

facility is December 2010. There have been no new

borrowings under the Loan Agreement since December

2005.

We also had similar secured funding arrangements

with GE in the U.K. and Canada. In July 2007 and

December 2007, we repaid the outstanding loans under

those arrangements of £293 million (U.S. $593) and Cdn.

$41 million (U.S. $41) in the U.K. and Canada, respectively.

France Secured Borrowings: In October 2007, our

secured warehouse financing facility in France matured

and we repaid the outstanding borrowings of €331 million

(U.S. $469) under this program with proceeds from an

unsecured bank bridge loan due March 31, 2008.

DLL Secured Borrowings: In July 2007, we purchased

De Lage Landen’s (“DLL”) 51% ownership interest in our

lease financing joint venture in the Netherlands for $25

including accumulated dividends of $9. In connection with

the purchase, the secured borrowings to DLL of $153 were

repaid and the related finance receivables are no longer

encumbered. To fund the purchase and repayment we

borrowed $161 of unsecured bank debt due July 1, 2008.

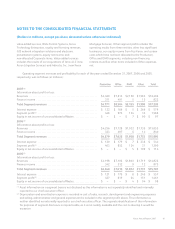

The following table shows finance receivables and related secured debt as of December 31, 2007 and 2006.

Although the finance receivables are consolidated assets they are generally not available to satisfy our other obligations:

December 31, 2007 December 31, 2006

(in millions)

Finance

Receivables,

Net Secured

Debt

Finance

Receivables,

Net Secured

Debt

GE – U.S. ............................................................. $ 377 $275 $ 941 $ 782

GE – U.K. ............................................................ – – 669 609

GE – Canada ......................................................... – – 115 88

Merrill Lynch – France ................................................. – – 501 419

DLL – Netherlands .................................................... – – 197 161

Total encumbered finance receivables, net ................... $ 377 $275 $2,423 $2,059

Unencumbered finance receivables, net ........................ 7,671 5,421

Total finance receivables, net(1) ....................................... $8,048 $7,844

(1) Includes (i) billed portion of finance receivables, net, (ii) finance receivables, net and (iii) finance receivables due after

one year, net as included in the Consolidated Balance Sheets as of December 31, 2007 and 2006.

Accounts Receivable Sales Arrangement: We have a

facility in Europe that enables us to sell, on an on-going

basis, certain accounts receivables without recourse to a

third-party. During 2007 and 2006, we sold approximately

$326 and $23, respectively, of accounts receivables under

this facility. Fees associated with the 2007 sales were $2.

Of the amounts sold, $170 remained uncollected by the

third-party as of December 31, 2007.

Xerox Annual Report 2007 95