Xerox 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

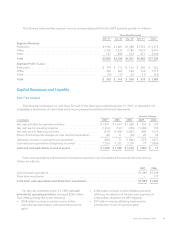

The following table summarizes our debt as of

December 31,

(in millions) 2007 2006

Debt secured by finance receivables . . $ 275 $2,059

Capital leases ....................... 19 28

Total Secured Debt .................. 294 2,087

Senior Notes ........................ 5,781 4,224

Subordinated debt .................. 19 19

2007 Credit Facility ................. 600 –

Other Debt ......................... 770 815

Total Unsecured Debt ............... 7,170 5,058

Total Debt ......................... $7,464 $7,145

At December 31, 2007, approximately 4% of total

debt was secured by finance receivables and other assets

compared to 29% at December 31, 2006.

Credit Facility: In April 2007, we amended and

restated our $1.25 billion unsecured revolving credit

facility that was originally entered into in April 2006. The

amended and restated 2007 Credit Facility (“2007 Credit

Facility”) increased the maximum amount available for

borrowing to $2 billion and includes a $300 million letter

of credit subfacility. As of December 31, 2007, we had

borrowings of $600 million and no outstanding letters of

credit under the 2007 Credit Facility.

Refer to Note 11 – Debt in the Consolidated Financial

Statements for further information regarding our 2007

Credit Facility.

Liquidity, Financial Flexibility and Other Financing

Activity

Liquidity: We manage our worldwide liquidity using

internal cash management practices, which are subject to

(1) the statutes, regulations and practices of each of the

local jurisdictions in which we operate, (2) the legal

requirements of the agreements to which we are a party

and (3) the policies and cooperation of the financial

institutions we utilize to maintain and provide cash

management services.

As of December 31, 2007, we had $1.1 billion of cash

and cash equivalents and borrowing capacity under our

2007 Credit Facility of $1.4 billion. Our ability to maintain

positive liquidity going forward depends on our ability to

continue to generate cash from operations and access the

financial markets, both of which are subject to general

economic, financial, competitive, legislative, regulatory

and other market factors that are beyond our control.

Share Repurchase Programs: The Board of Directors

has authorized programs for the repurchase of the

Company’s common stock totaling $2.5 billion as of

December 31, 2007. Since launching this program in

October 2005, we have repurchased 137 million shares,

totaling approximately $2.1 billion of the $2.5 billion

authorized through December 31, 2007. In January 2008,

the Board of Directors authorized an additional $1 billion

for share repurchase.

Refer to Note 17 – Shareholders’ Equity – “Treasury

Stock” in the Consolidated Financial Statements for

further information regarding our share repurchase

programs.

Dividends: In the fourth quarter of 2007, the Board

of Directors declared a 4.25 cent per share dividend on

common stock payable January 31, 2008 to shareholders

of record on December 31, 2007.

Loan Covenants and Compliance: At December 31,

2007, we were in full compliance with the covenants and

other provisions of the 2007 Credit Facility, the senior

notes and the Loan Agreement. Failure to be in

compliance with any material provision or covenant of

these agreements could have a material adverse effect on

our liquidity and operations and our ability to continue to

fund our customers’ purchase of Xerox equipment. We

have the right to prepay any outstanding loans or to

terminate the 2007 Credit Facility without penalty.

Refer to Note 11 – Debt and Note 4 – Receivables,

Net in the Consolidated Financial Statements for

additional information regarding the senior notes and

Loan agreement, respectively.

Financial Instruments: Refer to Note 13 –Financial

Instruments in the Consolidated Financial Statements for

additional information regarding our derivative financial

instruments.

Capital Markets Offerings and Other: In 2007, we

raised net proceeds of $1.5 billion through the issuance of

Senior Notes due in 2012 and zero coupon bond

transactions. Refer to Note 11-Debt in the Consolidated

Financial Statements for additional information regarding

these transactions.

72