Xerox 2007 Annual Report Download - page 119

Download and view the complete annual report

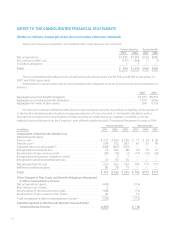

Please find page 119 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Included in the balance at January 1, 2007 and as of

December 31, 2007 are $93 and $137, respectively, of tax

positions that are highly certain of realizability but for

which there is uncertainty about the timing or may be

reduced through an indirect benefit from other taxing

jurisdictions. Because of the impact of deferred tax

accounting, other than interest and penalties, the

disallowance of these positions would not affect the

annual effective tax rate.

We have filed claims in certain jurisdictions to assert

our position should the law be clarified by judicial means.

At this point in time, we believe it is unlikely that we will

receive any benefit from these types of claims but we will

continue to analyze as the issues develop. Accordingly, we

have not included any benefit for these types of claims in

the amount of unrecognized tax benefits.

Upon the adoption of FIN 48, we recognize interest

and penalties accrued on unrecognized tax benefits as

well as interest received from favorable settlements within

income tax expense. In 2007, net interest and penalties

were less than $1. We had $28 and $23 accrued for the

payment of interest and penalties associated with

unrecognized tax benefits at January 1, 2007 and

December 31, 2007, respectively.

We file income tax returns in the U.S. federal

jurisdiction and various foreign jurisdictions. In the U.S. we

are no longer subject to U.S. federal income tax

examinations by tax authorities for years before 2006.

With respect to our major foreign jurisdictions, we are no

longer subject to tax examinations by tax authorities

before 2000.

2006 Audit Resolution: In the first quarter 2006, we

recognized an income tax benefit of $24 from the

favorable resolution of certain tax issues associated with

our 1999-2003 Internal Revenue Service (“IRS”) audit

which at the time had not yet been finalized. In the

second quarter 2006, we recognized an income tax

benefit of $46 related to the favorable resolution of

certain tax matters associated with the finalization of

foreign tax audits. In the third quarter 2006, we received

notice that the U.S. Joint Committee on Taxation had

completed its review of our 1999-2003 IRS audit and as a

result of that review our audit for those years had been

finalized. Accordingly, we recorded an aggregate income

tax benefit of $448 associated with the favorable

resolution of certain tax matters from this audit. The

recorded benefit did not result in a significant cash refund,

but it did increase tax credit carryforwards and reduce

taxes otherwise potentially due.

2005 Audit Resolution: In the second quarter of

2005, the 1996-1998 IRS audit was finalized. As a

result, we recorded an aggregate second quarter 2005

net income benefit of $343. $260 of this benefit, which

includes an after-tax benefit of $33 for interest ($54

pre-tax benefit), is the result of a change in tax law

that allowed us to recognize a benefit for $1.2 billion of

capital losses associated with the disposition of our

insurance group operations in those years. The claim of

additional losses and related tax benefits required

review by the U.S. Joint Committee on Taxation, which

was completed in June 2005. The benefit did not result

in a significant cash refund, but increased tax credit

carryforwards and reduced taxes otherwise potentially

due.

Deferred Income Taxes

In substantially all instances, deferred income

taxes have not been provided on the undistributed

earnings of foreign subsidiaries and other foreign

investments carried at equity. The amount of such

earnings included in consolidated retained earnings at

December 31, 2007 was approximately $7.5 billion.

These earnings have been indefinitely reinvested and

we currently do not plan to initiate any action that

would precipitate the payment of income taxes

thereon. It is not practicable to estimate the amount of

additional tax that might be payable on the foreign

earnings. Our 2001 sale of half of our ownership

interest in Fuji Xerox resulted in our investment no

longer qualifying as a foreign corporate joint venture.

Accordingly, deferred taxes are required to be provided

on the undistributed earnings of Fuji Xerox, arising

subsequent to such date, as we no longer have the

ability to ensure indefinite reinvestment.

Xerox Annual Report 2007 117