Xerox 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

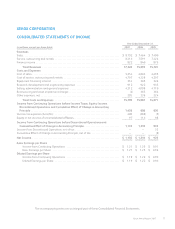

XEROX CORPORATION

CONSOLIDATED STATEMENTS OF COMMON SHAREHOLDERS’ EQUITY

(in millions, except share data in thousands)

Common

Stock

Shares

Common

Stock

Amount

Additional

Paid-In-

Capital

Treasury

Stock

Shares

Treasury

Stock

Amount Retained

Earnings

Accumulated

Other

Comprehensive

Loss (1) Total

Balance at January 1, 2005 ................... 955,997 $956 $ 3,925 – $ – $2,101 $ (738) $ 6,244

Net income . . . . . . . . ........................... – – – – – 978 – 978

Translation adjustments ....................... – – – – – – (493) (493)

Minimum pension liability ...................... – – – – – – (6) (6)

Other unrealized losses ........................ – – – – – – (3) (3)

Comprehensive income ....................... $ 476

Stock option and incentive plans, net . . . ......... 5,548 6 84 – – – – 90

Series C mandatory convertible preferred stock

dividends ($6.25 per share) .................. – – – – – (58) – (58)

Payments to acquire treasury stock ............. – – – (30,502) (433) – – (433)

Cancellation of treasury stock .................. (16,585) (17) (213) 16,585 230 – – –

Other . . . . . . . . . . . . . . .......................... 146 – – – – – – –

Balance at December 31, 2005 ................ 945,106 $945 $ 3,796 (13,917) $ (203) $3,021 $(1,240) $ 6,319

Net income . . . . . . . . ........................... – – – – – 1,210 – 1,210

Translation adjustments ....................... – – – – – – 485 485

Minimum pension liability ...................... – – – – – – 131 131

Other unrealized gains ......................... – – – – – – 1 1

Comprehensive income ....................... $ 1,827

Adjustment to initially apply FAS No. 158, net

(Refer to Note 1) ............................ – – – – – – (1,024) (1,024)

Stock option and incentive plans, net . . . ......... 10,256 11 156 – – – – 167

Series C mandatory convertible preferred stock

dividends ($6.25 per share) .................. – – – – – (29) – (29)

Series C mandatory convertible preferred stock

conversion . . . . . ............................ 74,797 75 814 – – – – 889

Payments to acquire treasury stock ............. – – – (70,111) (1,069) – – (1,069)

Cancellation of treasury stock .................. (75,665) (75) (1,056) 75,665 1,131 – – –

Other . . . . . . . . . . . . . . .......................... 74 – – – – – – –

Balance at December 31, 2006 ................ 954,568 $956 $ 3,710 (8,363) $ (141) $4,202 $(1,647) $ 7,080

Net income . . . . . . . . ........................... – – – – – 1,135 – 1,135

Translation adjustments ....................... – – – – – – 501 501

Cumulative Effect of Change in Accounting

Principles (Refer to Note 1) . .................. – – – – – (9) – (9)

Changes in defined benefit plans (Refer to

Note 14)(2) ................................. – – – – – – 382 382

Other unrealized losses ........................ – – – – – – (1) (1)

Comprehensive income ....................... $ 2,008

Cash dividends declared .......................

Common stock ($0.0425 per share) ............. – – – – – (40) – (40)

Stock option and incentive plans, net . . . ......... 7,588 7 165 – – – – 172

Payments to acquire treasury stock ............. – – – (36,638) (632) – – (632)

Cancellation of treasury stock .................. (43,165) (43) (699) 43,165 742 – – –

Other . . . . . . . . . . . . . . .......................... 22 – – – – – – –

Balance at December 31, 2007 ................ 919,013 $920 $ 3,176 (1,836) $ (31) $5,288 $ (765) $ 8,588

(1) Refer to Note 1 “Accumulated Other Comprehensive Loss (AOCL)” for components of AOCL.

(2) Includes charge of $(5) for Fuji Xerox’s initial adoption of FAS No. 158 (Refer to Note 1).

The accompanying notes are an integral part of these Consolidated Financial Statements.

80