Xerox 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Worldwide Employment

Worldwide employment of 57,400 as of

December 31, 2007 increased approximately 3,700 from

December 31, 2006, primarily reflecting the addition of

GIS personnel and the hiring of former contract

employees in certain Latin American subsidiaries, partially

offset by reductions from the 2006 restructuring

programs. Worldwide employment was approximately

53,700 and 55,200 at December 31, 2006 and 2005,

respectively.

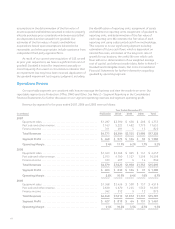

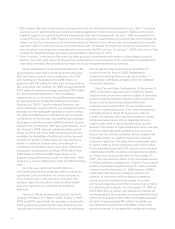

Other Expenses, Net

Other expenses, net for the three years ended December 31, 2007 consisted of the following:

Year Ended December 31,

(in millions) 2007 2006 2005

Non-financing interest expense ............................................... $263 $239 $ 231

Interest income .............................................................. (55) (69) (138)

Gain on sales of businesses and assets ......................................... (7) (44) (97)

Currency losses, net .......................................................... 8 39 5

Amortization of intangible assets .............................................. 42 41 38

Legal matters ................................................................ (6) 89 115

Minorities’ interests in earnings of subsidiaries .................................. 30 22 15

Loss on extinguishment of debt ............................................... – 15 –

All other expenses, net ........................................................ 20 4 55

Total Other expenses, net ..................................................... $295 $336 $ 224

Non-financing interest expense: In 2007

non-financing interest expense increased primarily due to

higher average debt balances as well as higher rates. In

2006 non-financing interest expense increased due to

higher interest rates partially offset by lower average debt

balances.

Interest income: Interest income is derived primarily

from our invested cash and cash equivalent balances. The

decline in interest income in 2007 was primarily due to

lower average cash balances partially offset by higher

rates. The decline in 2006 was primarily because 2005

included $57 million of interest income associated with

the 2005 settlement of the 1996-1998 IRS audit as well as

lower average cash balances partially offset by higher

rates of return.

Gain on sales of businesses and assets: 2006 gain on

sales of businesses and assets primarily consisted of the

following:

• $15 million on the sale of our Corporate headquarters.

• $11 million on the sale of a manufacturing facility.

• $10 million receipt from escrow of additional proceeds

related to our 2005 sale of Integic.

In 2005, gain on sales of businesses and assets

primarily consist of the $93 million gain on the sale of

Integic.

Currency (gains) losses net: Currency gains and losses

primarily result from the re-measurement of foreign

currency-denominated assets and liabilities, the cost of

hedging foreign currency-denominated assets and

liabilities, the mark-to-market of any foreign exchange

contracts utilized to hedge those foreign currency-

denominated assets and liabilities and the mark-to-market

impact of hedges of anticipated transactions, primarily

future inventory purchases, for those we do not apply cash

flow hedge accounting treatment.

In 2007, 2006 and 2005 currency losses totaled $8

million, $39 million and $5 million, respectively. The 2006

increase in currency losses primarily reflected the

mark-to-market of derivative contracts which are

economically hedging anticipated foreign currency

denominated payments. The mark-to-market losses were

primarily due to the strengthening of the Euro against

other currencies, in particular the Canadian Dollar,

U.S. Dollar and Japanese Yen, as compared to the

weakening Euro in 2005.

Amortization of intangible assets: 2007 amortization

of intangible assets expense of $42 million reflects

amortization expense of $16 million associated with

intangible assets acquired as part of our acquisition of

GIS, partially offset by reduced amortization from prior

Xerox Annual Report 2007 65