Xerox 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

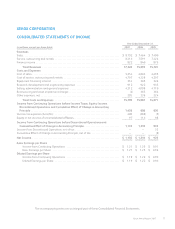

XEROX CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31,

(in millions) 2007 2006 2005

Cash Flows from Operating Activities:

Net income .......................................................................... $1,135 $ 1,210 $ 978

Adjustments required to reconcile net income to cash flows from operating activities:

Depreciation and amortization .................................................... 656 636 641

Provisions for receivables and inventory ............................................ 197 145 107

Deferred tax expense (benefit) .................................................... 224 99 (15)

Net gain on sales of businesses and assets ......................................... (7) (44) (97)

Undistributed equity in net income of unconsolidated affiliates ...................... (60) (70) (54)

Stock-based compensation ....................................................... 89 64 40

Restructuring and asset impairment charges ....................................... (6) 385 366

Cash payments for restructurings .................................................. (235) (265) (214)

Contributions to pension benefit plans ............................................. (298) (355) (388)

(Increase) decrease in inventories ................................................. (43) 11 (162)

Increase in equipment on operating leases ......................................... (331) (271) (248)

Decrease in finance receivables ................................................... 119 192 254

Increase in accounts receivable and billed portion of finance receivables .............. (79) (30) (34)

Decrease in other current and long-term assets ..................................... 130 64 160

Increase in accounts payable and accrued compensation ............................ 285 330 313

Net change in income tax assets and liabilities ...................................... 73 (459) (211)

Net change in derivative assets and liabilities ....................................... (10) 9 38

Increase (decrease) in other current and long-term liabilities ......................... 38 (70) 7

Other, net ....................................................................... (6) 36 (61)

Net cash provided by operating activities ...................................... 1,871 1,617 1,420

Cash Flows from Investing Activities:

Purchases of short-term investments ............................................... (18) (162) (386)

Proceeds from sales of short-term investments ...................................... 155 269 139

Cost of additions to land, buildings and equipment .................................. (236) (215) (181)

Proceeds from sales of land, buildings and equipment ............................... 25 82 5

Cost of additions to internal use software .......................................... (123) (79) (56)

Proceeds from divestitures and investments, net .................................... – 153 105

Acquisitions, net of cash acquired ................................................. (1,615) (229) (1)

Net change in escrow and other restricted investments .............................. 200 38 80

Net cash used in investing activities ........................................... (1,612) (143) (295)

Cash Flows from Financing Activities:

Cash proceeds from new secured financings ........................................ 62 121 557

Debt payments on secured financings ............................................. (1,931) (1,712) (1,879)

Net cash proceeds (payments) on other debt ....................................... 1,814 1,276 (1,187)

Payment of liability to subsidiary trust issuing preferred securities .................... – (100) –

Preferred stock dividends ......................................................... – (43) (58)

Proceeds from issuances of common stock ......................................... 65 82 40

Excess tax benefits from stock-based compensation ................................. 22 25 –

Payments to acquire treasury stock, including fees .................................. (632) (1,069) (433)

Other ........................................................................... (19) (8) (2)

Net cash used in financing activities ........................................... (619) (1,428) (2,962)

Effect of exchange rate changes on cash and cash equivalents ........................... 60 31 (59)

(Decrease) increase in cash and cash equivalents ........................................ (300) 77 (1,896)

Cash and cash equivalents at beginning of year ......................................... 1,399 1,322 3,218

Cash and cash equivalents at end of year ............................................. $ 1,099 $ 1,399 $ 1,322

The accompanying notes are an integral part of these Consolidated Financial Statements.

Xerox Annual Report 2007 79