Xerox 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

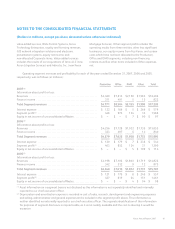

Note 7 – Investments in Affiliates, at Equity

Investments in corporate joint ventures and other

companies in which we generally have a 20% to 50%

ownership interest at December 31, 2007 and 2006 were

as follows (in millions):

2007 2006

Fuji Xerox .............................. $887 $834

All other equity investments ............. 45 40

Investments in affiliates, at equity ...... $932 $874

Fuji Xerox is headquartered in Tokyo and operates in

Japan, China, Australia, New Zealand and other areas of

the Pacific Rim. Our investment in Fuji Xerox of $887 at

December 31, 2007, differs from our implied 25% interest

in the underlying net assets, or $972, due primarily to our

deferral of gains resulting from sales of assets by us to Fuji

Xerox, partially offset by goodwill related to the Fuji Xerox

investment established at the time we acquired our

remaining 20% of Xerox Limited from The Rank Group

plc.

Our equity in net income of our unconsolidated

affiliates for the three years ended December 31, 2007

was as follows:

2007 2006 2005

Fuji Xerox ........................ $89 $107 $90

Other investments ................ 8 7 8

Total ........................ $97 $114 $98

Equity in net income of Fuji Xerox is affected by

certain adjustments to reflect the deferral of profit

associated with intercompany sales. These adjustments

may result in recorded equity income that is different than

that implied by our 25% ownership interest. Equity

income for 2007 includes after-tax restructuring charges

of $30 primarily reflecting employee related costs as part

of Fuji Xerox’s continued cost-reduction actions to

improve its competitive position.

98