Xerox 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

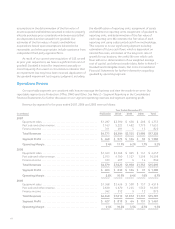

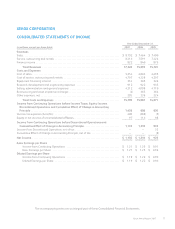

The following table provides segment revenue and operating profit for the 2007 quarterly periods (in millions):

Three Months Ended

Mar. 31 Jun. 30 Sep. 30 Dec. 31 Total

Segment Revenue:

Production ....................................................... $1,194 $1,281 $1,286 $1,554 $ 5,315

Office ........................................................... 2,105 2,327 2,384 2,657 9,473

Other ............................................................ 537 600 632 671 2,440

Total $3,836 $4,208 $4,302 $4,882 $17,228

Segment Profit / (Loss):

Production ....................................................... $ 119 $ 111 $ 126 $ 206 $ 562

Office ........................................................... 259 267 259 330 1,115

Other ............................................................ (16) (31) (25) (17) (89)

Total $ 362 $ 347 $ 360 $ 519 $ 1,588

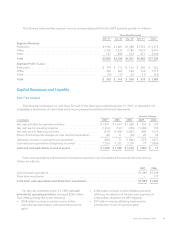

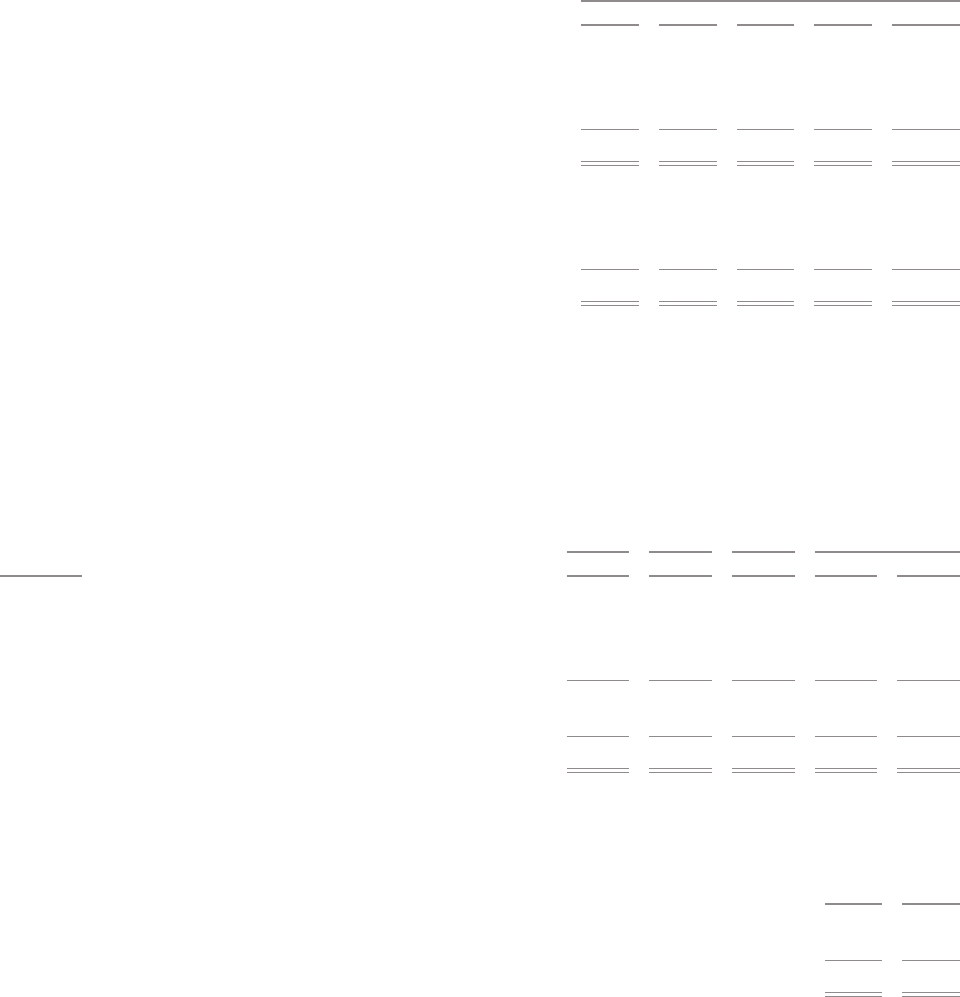

Capital Resources and Liquidity

Cash Flow Analysis

The following summarizes our cash flows for each of the three years ended December 31, 2007, as reported in our

Consolidated Statements of Cash Flows in the accompanying Consolidated Financial Statements:

Amount Change

(in millions) 2007 2006 2005 2007 2006

Net cash provided by operating activities ......................... $1,871 $ 1,617 $ 1,420 $ 254 $ 197

Net cash used in investing activities .............................. (1,612) (143) (295) (1,469) 152

Net cash used in financing activities .............................. (619) (1,428) (2,962) 809 1,534

Effect of exchange rate changes on cash and cash equivalents ...... 60 31 (59) 29 90

(Decrease) increase in cash and cash equivalents .................. (300) 77 (1,896) (377) 1,973

Cash and cash equivalents at beginning of period ................. 1,399 1,322 3,218 77 (1,896)

Cash and cash equivalents at end of period ..................... $ 1,099 $ 1,399 $ 1,322 $ (300) $ 77

Cash, cash equivalents and Short-term investments reported in our Consolidated Financial Statements were as

follows (in millions):

2007 2006

Cash and cash equivalents ..................................................................... $1,099 $1,399

Short-term investments ....................................................................... – 137

Total Cash, cash equivalents and Short-term investments ...................................... $1,099 $1,536

For the year ended December 31, 2007, net cash

provided by operating activities, increased $254 million

from 2006 primarily due to the following:

• $348 million increase in pre tax income before

restructuring, depreciation, other provisions and net

gains.

• $108 million increase in other liabilities primarily

reflecting the absence of the prior year payment of

$106 million related to the MPI litigation.

• $57 million increase reflecting lower pension

contributions to our U.S. pension plans.

Xerox Annual Report 2007 69