Xerox 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 16% growth in color post sale and other revenue.

Color sales represented 31% of post sale and other

revenue in 2006 compared to 28% in 2005. In

2006, approximately 9% of our pages were

printed on color devices, which was up from 7% in

2005.

• 9% growth in color equipment sales revenue. The

pace of color equipment sales growth was

impacted by lower OEM color printer sales. Color

sales represented approximately 45% of total

equipment sales in 2006 compared to 41% in

2005.

(1) Post sale revenue is largely a function of the equipment

placed at customer locations, the volume of prints and

copies that our customers make on that equipment, the

mix of color pages, as well as associated services.

(2) Color revenues represent a subset of total revenues and

excludes the impact of GIS.

(3) The percentage point impacts from GIS reflect the

revenue growth year-over-year after including GIS’

results from 2006 on a proforma basis. See page 76 for

an explanation of this non-GAAP measure.

(4) As of December 31, 2007, total color, color post sale,

financing and other, and color equipment sales

revenues comprised 37%, 34% and 46%, respectively,

if calculated on total, total post sale, financing and

other, and total equipment sales revenues, including

GIS. GIS is excluded from the color information

presented, as the breakout of the information required

to make this computation for all periods is not available.

2008 Projected Revenues

Excluding currency impacts, we expect 2008 revenue

to grow moderately driven by continued increases in

annuity revenue. We anticipate that new launches

combined with products and applications launched during

the prior two years, and the businesses acquired in 2007,

will enable us to further strengthen our market position.

Growth in post sale and other revenue will be driven

by our success in increasing the volume of equipment

installed at customer locations, volume of pages and mix

of color pages generated on that equipment, as well as

growth in document management services.

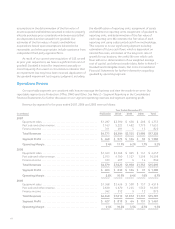

Net Income

Net income and diluted earnings per share for the three years ended December 31, 2007 were as follows:

(in millions, except per share amounts) 2007 2006 2005

Net income ........................................................................... $1,135 $1,210 $ 978

Diluted earnings per share ............................................................. $ 1.19 $ 1.22 $0.94

2007 Net income of $1,135 million, or $1.19 per

diluted share, decreased $75 million or $0.03 per diluted

share from 2006 primarily reflecting:

• Gross profit increase of $492 million due to increased

revenue of $1,333 million, including the addition of

GIS.

• Increase in selling, administrative and general

expenses of $304 million due primarily to the inclusion

of GIS.

• Decrease in restructuring and asset impairment

charges of $391 million. 2006 restructuring charges

were $385 million ($257 million after-tax).

• Decrease in Other expenses, net of $41 million due to

2006 charges of $68 million (pre and post tax) related

to probable losses for Brazilian labor-related

contingencies and a $13 million ($9 million after-tax)

charge resulting from the termination of a previous

credit facility.

• Increase in income tax expense of $688 million due to

higher pre-tax income as well as the absence of the

following 2006 income tax benefits:

• $472 million related to the favorable resolution of

certain tax matters from the 1999-2003 IRS audit.

• $46 million tax benefit resulting from the

resolution of certain tax matters associated with

foreign tax audits.

• Decrease in equity income of $17 million primarily

attributable to charges of $30 million for our share of

Fuji Xerox restructuring.

2006 Net income of $1,210 million, or $1.22 per

diluted share, increased $232 million or $0.28 per diluted

share from 2005 primarily reflecting:

• $472 million income tax benefit related to the

favorable resolution of certain tax matters from the

1999-2003 IRS audit.

Xerox Annual Report 2007 55