Xerox 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the year ended December 31, 2007, net cash

used in financing activities, decreased $809 million from

2006 primarily due to the following:

• $538 million decrease due to higher net cash proceeds

from unsecured debt. This reflects the May 2007

issuance of the $1.1 billion Senior Notes, the issuances

of two zero coupon bonds in 2007 resulting in net

proceeds of approximately $400 million, and the net

drawdown of $600 million under the 2007 Credit

Facility. These higher net proceeds were partially

offset by the March 2006 issuance of the $700 million

Senior Notes and the August 2006 issuance of an

additional $650 million of Senior Notes, as well as,

higher repayments on other unsecured debt in 2007 as

compared to 2006.

• $437 million decrease due to lower purchases under

our share repurchase program as cash was invested in

acquisitions.

• $100 million decrease relating to the 2006 payment

of our liability to Xerox Capital LLC in connection with

their redemption of Canadian deferred preferred

shares.

• $278 million increase due to higher net repayments of

secured financing. (refer to Note 4-Receivables, net in

the consolidated financial statements for further

information).

For the year ended December 31, 2006, net cash

used in financing activities decreased $1.5 billion from

2005 primarily as a result of the following:

• $2,463 million lower usage primarily resulting from the

2005 net repayments on term and other unsecured

debt, of $1,187 million, as contrast to the 2006 net

borrowings of term and other unsecured debt of

$1,276 million. The 2006 net borrowings primarily

reflect the 2016 Senior Notes borrowing of $700

million in March 2006, 2017 Senior Notes borrowing of

$500 million in August 2006 and the 2009 Senior

Notes borrowing of $150 million in August 2006.

• $42 million due to higher proceeds from the issuance

of common stock, resulting from increases in exercised

stock options.

• Partially offsetting these items were the following:

• $636 million higher cash usage for the acquisition

of common stock under the authorized share

repurchase programs.

• $269 million higher net repayments on secured

borrowings.

• $100 million payment of liability to Xerox Capital

LLC in connection with their redemption of

Canadian deferred preferred shares in February

2006.

Financing Activities

Customer Financing Activities and Secured Debt: We

provide equipment financing to the majority of our

customers. Because the finance leases allow our customers

to pay for equipment over time rather than at the date of

installation, we maintain a certain level of debt to support

our investment in these customer finance leases. We

currently fund our customer financing activity through

cash generated from operations, cash on hand, borrowings

under bank credit facilities, and proceeds from capital

markets offerings.

We have arrangements in certain international

countries and domestically through the acquisition of GIS,

in which third party financial institutions originate lease

contracts directly with our customers. In these

arrangements, we sell and transfer title of the equipment

to these financial institutions. Generally, we have no

continuing ownership rights in the equipment subsequent

to its sale; therefore, the related receivable and debt are

not included in our Consolidated Financial Statements.

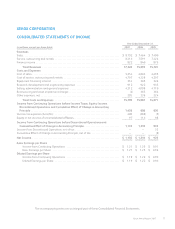

The following represents total finance assets

associated with our lease or finance operations as of

December 31, 2007 and 2006, respectively (in millions):

2007 2006

Total Finance receivables, net(1) ....... $8,048 $7,844

Equipment on operating leases, net . . . 587 481

Total Finance Assets, net ............ $8,635 $8,325

(1) Includes (i) billed portion of finance receivables, net,

(ii) finance receivables, net and (iii) finance receivables

due after one year, net as included in the Consolidated

Balance Sheets as of December 31, 2007 and 2006.

Refer to Note 4 – Receivables, Net in the

Consolidated Financial Statements for further information

regarding our third party secured funding arrangements

and a comparison of finance receivables to our financing-

related debt as of December 31, 2007 and 2006. As of

December 31, 2007, approximately 5% of total finance

receivables were encumbered as compared to 31% at

December 31, 2006.

Xerox Annual Report 2007 71