Xerox 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

partially offset by higher interest expense and lower gains

on the sales of businesses and assets.

2006 Operating profit of $31 million decreased $120

million from 2005, reflecting:

• The absence of the following items that occurred in

2005: $93 million gain related to the sale of Integic

and the $57 million interest benefit from the

finalization of the 1996-1998 Internal Revenue

Service tax audit.

• $13 million pre-tax write-off resulting from the

termination of a previous credit facility.

• Lower interest income of $12 million and increased

non-financing interest expense of $8 million.

The above were partially offset by the following:

• Increased paper profit due to increased sales and

reduced SAG expenses resulting from organizational

streamlining.

• $44 million in gains on sale of assets.

Costs, Expenses and Other Income

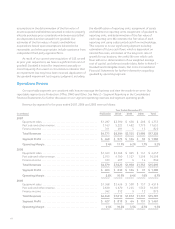

Gross Margin

Gross margins by revenue classification were as

follows:

Year Ended December 31,

(in millions) 2007 2006 2005

Total Gross margin .... 40.3% 40.6% 41.2%

Sales ............. 35.9% 35.7% 36.6%

Service,

outsourcing and

rentals ......... 42.7% 43.0% 43.3%

Finance income . . . 61.6% 63.7% 62.7%

2007 Total Gross margin was down slightly as

compared to 2006 as cost improvements were offset by

price and product mix.

• Sales gross margin increased 0.2-percentage points

primarily as cost improvements and other variances

more than offset the 2.0-percentage point impact of

price declines.

• Service, outsourcing and rentals margin decreased

0.3-percentage points as cost improvements and

other variances did not fully offset price declines and

unfavorable product mix of approximately

2.0-percentage points.

• Financing income margin declined 2.1-percentage

points reflecting additional interest expense due to

higher interest rates. Equipment financing interest is

determined based on an estimated cost of funds,

applied against an estimated level of debt required

to fund our net finance receivables on a 7 to 1 debt

to equity leverage ratio (refer to Note 11- Debt in the

Consolidated Financial Statements for further

information).

2006 Total Gross margin decreased by

0.6-percentage points from 2005 due to product mix.

Price declines of 1.4-percentage points were offset by

productivity improvements and other variances of

1.4-percentage points.

• Sales gross margin decreased 0.9-percentage points

from 2005 as price declines of 2.1-percentage points

exceeded the combined impacts of productivity

improvements, product mix and other variances of

1.2-percentage points.

• Service, outsourcing and rentals margin decreased

0.3-percentage points from 2005 as product mix

decline of 1.3-percentage points exceeded the

impact of productivity improvements, price and other

variances of 1.0-percentage points.

• Financing income margin increased 1.0-percentage

points due to changes in interest costs specific to

equipment financing.

Research, Development and Engineering Expenses

(“R,D&E”)

(in millions)

Year Ended December 31, Change

2007 2006 2005 2007 2006

Total R,D&E

expenses . . $912 $922 $943 $ 10 $ (21)

R,D&E %

Revenue . . . 5.3% 5.8% 6.0% (0.5)pts (0.2)pts

2007 R,D&E of $912 million decreased $10 million

from 2006. We expect our 2008 R,D&E spending to

approximate 5% to 5.5% of total revenue.

• R&D of $764 million increased $3 million from 2006.

We invest in technological development, particularly

in color, and believe our R&D spending is sufficient to

remain technologically competitive. Our R&D is

strategically coordinated with that of Fuji Xerox,

which invested $672 million and $660 million in R&D

in 2007 and 2006, respectively.

Xerox Annual Report 2007 63