Xerox 2007 Annual Report Download - page 129

Download and view the complete annual report

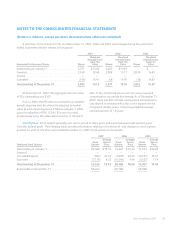

Please find page 129 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

• Guarantees of our performance in certain sales and

services contracts to our customers and indirectly the

performance of third parties with whom we have

subcontracted for their services. This includes

indemnifications to customers for losses that may be

sustained as a result of the use of our equipment at a

customer’s location.

In each of these circumstances, our payment is

conditioned on the other party making a claim pursuant to

the procedures specified in the particular contract, which

procedures typically allow us to challenge the other

party’s claims. In the case of lease guarantees, we may

contest the liabilities asserted under the lease. Further, our

obligations under these agreements and guarantees may

be limited in terms of time and/or amount, and in some

instances, we may have recourse against third parties for

certain payments we made.

Patent indemnifications: In most sales transactions to

resellers of our products, we indemnify against possible

claims of patent infringement caused by our products or

solutions. These indemnifications usually do not include

limits on the claims, provided the claim is made pursuant

to the procedures required in the sales contract.

Indemnification of Officers and Directors: Our

corporate by-laws require that, except to the extent

expressly prohibited by law, we must indemnify Xerox

Corporation’s officers and directors against judgments,

fines, penalties and amounts paid in settlement, including

legal fees and all appeals, incurred in connection with civil

or criminal action or proceedings, as it relates to their

services to Xerox Corporation and our subsidiaries.

Although the by-laws provide no limit on the amount of

indemnification, we may have recourse against our

insurance carriers for certain payments made by us.

However, certain indemnification payments may not be

covered under our directors’ and officers’ insurance

coverage. In addition, we indemnify certain fiduciaries of

our employee benefit plans for liabilities incurred in their

service as fiduciary whether or not they are officers of the

Company.

Product Warranty Liabilities: In connection with our

normal sales of equipment, including those under sales-

type leases, we generally do not issue product warranties.

Our arrangements typically involve a separate full service

maintenance agreement with the customer. The

agreements generally extend over a period equivalent to

the lease term or the expected useful life under a cash

sale. The service agreements involve the payment of fees

in return for our performance of repairs and maintenance.

As a consequence, we do not have any significant product

warranty obligations including any obligations under

customer satisfaction programs. In a few circumstances,

particularly in certain cash sales, we may issue a limited

product warranty if negotiated by the customer. We also

issue warranties for certain of our lower-end products in

the Office segment, where full service maintenance

agreements are not available. In these instances, we

record warranty obligations at the time of the sale.

Aggregate product warranty liability expenses for the

three years ended of December 31, 2007 were $40, $43

and $45, respectively. Total product warranty liabilities as

of December 31, 2007 and 2006 were $26 and $22,

respectively.

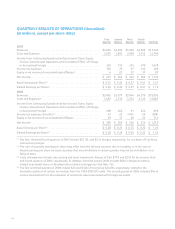

Note 17 – Shareholders’ Equity

Preferred Stock

As of December 31, 2007, we had no preferred stock

shares or preferred stock purchase rights outstanding. We

are authorized to issue approximately 22 million shares of

cumulative preferred stock, $1.00 par value.

Series C Mandatory Convertible Preferred Stock

Automatic Conversion: In 2006, all 9.2 million shares of

6.25% Series C Mandatory Convertible Preferred Stock

were converted at a rate of 8.1301 shares of our common

stock, or 74.8 million common stock shares. The recorded

value of outstanding shares at the time of conversion was

$889. The conversion occurred pursuant to the mandatory

automatic conversion provisions set at original issuance of

the Series C Preferred Stock. As a result of the automatic

conversion, there are no remaining outstanding shares of

our Series C Mandatory Convertible Preferred Stock.

Common Stock

We have 1.75 billion authorized shares of common

stock, $1 par value. At December 31, 2007, 97 million

shares were reserved for issuance under our incentive

Xerox Annual Report 2007 127