Xerox 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

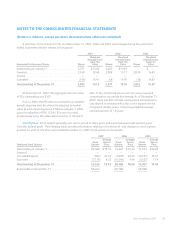

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Note 19 – Divestitures and Other Sales

During the three years ended December 31, 2007, the

following significant divestitures occurred:

Ridge Re: In March 2006, Ridge Re, a wholly owned

subsidiary included in our net investment in discontinued

operations (within Other long-term assets), completed an

agreement to transfer its obligations under its remaining

reinsurance agreement, together with related investments

held in trust, to another insurance company as part of a

complete exit from this business. As a result of this

transaction, the remaining investments held by Ridge Re

were sold and the excess cash held by Ridge Re of $119,

after the payment of its remaining liabilities, was

distributed back to the Company as part of a plan of

liquidation. This amount is presented within investing

activities in the Consolidated Statements of Cash Flows.

Integic: In March 2005, we completed the sale of our

entire equity interest in Integic Corporation (“Integic”) for

$96 in cash, net of transaction costs. The sale resulted in a

pre-tax gain of $93. Prior to this transaction, our

investment in Integic was accounted for using the equity

method and was included in Investments in affiliates, at

equity within our Consolidated Balance Sheets. The

pre-tax gain is classified within Other (income) expenses,

net in the accompanying Consolidated Statements of

Income. In May 2006, we recognized an additional pre-tax

gain of $10 on this sale from the receipt of additional

proceeds from escrow. The proceeds were placed in escrow

upon the sale of Integic pending completion of an

indemnification period.

REPORTS OF MANAGEMENT

Management’s Responsibility for Financial Statements

Our management is responsible for the integrity and

objectivity of all information presented in this annual

report. The consolidated financial statements were

prepared in conformity with accounting principles

generally accepted in the United States of America and

include amounts based on management’s best estimates

and judgments. Management believes the consolidated

financial statements fairly reflect the form and substance

of transactions and that the financial statements fairly

represent the Company’s financial position and results of

operations.

The Audit Committee of the Board of Directors, which

is composed solely of independent directors, meets

regularly with the independent auditors,

PricewaterhouseCoopers LLP, the internal auditors and

representatives of management to review accounting,

financial reporting, internal control and audit matters, as

well as the nature and extent of the audit effort. The Audit

Committee is responsible for the engagement of the

independent auditors. The independent auditors and

internal auditors have free access to the Audit Committee.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and

maintaining adequate internal control over financial

reporting, as such term is defined in the rules promulgated

under the Securities Exchange Act of 1934. Under the

supervision and with the participation of our

management, including our principal executive, financial

and accounting officers, we have conducted an evaluation

of the effectiveness of our internal control over financial

reporting based on the framework in “Internal Control –

Integrated Framework” issued by the Committee of

Sponsoring Organizations of the Treadway Commission.

Based on the above evaluation, management has

concluded that our internal control over financial reporting

was effective as of December 31, 2007.

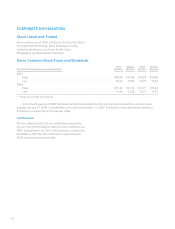

Anne M. Mulcahy

Chief Executive Officer

Lawrence A. Zimmerman

Chief Financial Officer

Gary R. Kabureck

Chief Accounting Officer

132