Xerox 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Ratings: Our credit ratings, which are periodically reviewed by major rating agencies, have substantially

improved and we are currently rated investment grade by all major rating agencies. As of January 31, 2008 the ratings

were as follows:

Senior Unsecured

Debt Outlook Comments

Moody’s(1) ................... Baa2 Positive The Moody’s rating was upgraded from Baa3 in November

2007, with a positive outlook.

Standard & Poors (“S&P”)(2) .... BBB- Stable The S&P rating was upgraded from BB+ to investment grade,

BBB-, in May 2007. Outlook is stable.

Fitch(3) ....................... BBB Stable The Fitch rating was upgraded from BBB- and a stable

outlook was affirmed in December 2007.

(1) On November 15, 2007, Moody’s raised its long term rating of Xerox to Baa2 from Baa3, with a positive outlook. The

following ratings were impacted: Senior Unsecured Debt to Baa2 from Baa3; Trust Preferred Securities to Baa3 from

Ba1; Xerox Credit Corp Senior Unsecured Debt to Baa2 from Baa3.

(2) In May 2007, S&P upgraded the Senior Unsecured and Corporate Credit ratings from BB+ to BBB-, investment grade,

with a stable outlook. At the same time, S&P upgraded the ratings on Subordinated Debt from BB- to BB+ and

Preferred Stock from B+ to BB. The ratings upgrade followed our announcement that we completed our tender offer

for GIS.

(3) On December 10, 2007, Fitch upgraded Xerox’s Issuer Default Rating to BBB from BBB-, with a stable outlook. The

following ratings were also impacted: Senior Unsecured Debt to BBB from BBB-; Senior Unsecured Credit Facility to

BBB from BBB- and Trust Preferred Securities to BBB- from BB.

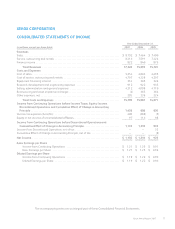

Contractual Cash Obligations and Other Commercial Commitments and Contingencies:

At December 31, 2007, we had the following contractual cash obligations and other commercial commitments and

contingencies (in millions):

2008 2009 2010 2011 2012 Thereafter

Long-term debt, including capital lease obligations(1) ....... $ 525 $1,552 $ 707 $ 808 $1,721 $2,151

Minimum operating lease commitments(2) ................ 266 212 169 129 90 158

Liability to subsidiary trust issuing preferred securities(3) .... –––––632

Retiree Health Payments ................................ 105 114 119 123 127 635

Purchase Commitments

Flextronics(4) ....................................... 716 –––– –

EDS Contracts(5) .................................... 290 150 17 16 16 15

Other(6) ............................................ 4 3 1 – – –

Total contractual cash obligations ...................... $1,906 $2,031 $1,013 $1,076 $1,954 $3,591

(1) Refer to Note 11 – Debt in our Consolidated Financial Statements for additional information and interest payments

related to long-term debt (amounts above include principal portion only).

(2) Refer to Note 6 – Land, Buildings and Equipment, Net in our Consolidated Financial Statements for additional

information related to minimum operating lease commitments.

(3) Refer to Note 12 – Liability to Subsidiary Trust Issuing Preferred Securities in our Consolidated Financial Statements

for additional information and interest payments (amounts above include principal portion only).

(4) Flextronics: We outsource certain manufacturing activities to Flextronics and are currently in the first year of the 2007

master supply agreement. This agreement is for three years with two additional one year extension periods at our

option.

Xerox Annual Report 2007 73