Xerox 2007 Annual Report Download - page 88

Download and view the complete annual report

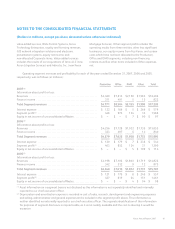

Please find page 88 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Sales to distributors and resellers: We utilize

distributors and resellers to sell certain of our products to

end-users. We refer to our distributor and reseller network

as our two-tier distribution model. Sales to distributors and

resellers are recognized as revenue when products are sold

to such distributors and resellers, as long as all

requirements for revenue recognition have been met.

Distributors and resellers participate in various cooperative

marketing and other programs, and we record provisions

for these programs as a reduction to revenue when the

sales occur. We also similarly account for our estimates of

sales returns and other allowances when the sales occur

based on our historical experience.

Supplies: Supplies revenue generally is recognized

upon shipment or utilization by customers in accordance

with the sales terms.

Software: Software included within our equipment

and services is generally considered incidental and is

therefore accounted for as part of the equipment sales or

services revenues. Software accessories sold in connection

with our equipment sales as well as free-standing software

revenues are accounted for in accordance with AICPA

Statement of Position No. 97-2, “Software Revenue

Recognition” (“SOP 97-2”). In most cases, these software

products are sold as part of multiple element

arrangements and include software maintenance

agreements for the delivery of technical service as well as

unspecified upgrades or enhancements on a

when-and-if-available basis. In those software accessory

and free-standing software arrangements that include

more than one element, we allocate the revenue among

the elements based on vendor-specific objective evidence

(“VSOE”) of fair value. VSOE of fair value is based on the

price charged when the deliverable is sold separately by us

on a regular basis and not as part of the multiple-element

arrangement. Revenue allocated to software is normally

recognized upon delivery while revenue allocated to the

software maintenance element is recognized ratably over

the term of the arrangement.

Revenue Recognition for Leases: Our accounting for

leases involves specific determinations under SFAS No. 13,

which often involve complex provisions and significant

judgments. The two primary criteria of SFAS No. 13 which

we use to classify transactions as sales-type or operating

leases are 1) a review of the lease term to determine if it is

equal to or greater than 75% of the economic life of the

equipment and 2) a review of the present value of the

minimum lease payments to determine if they are equal

to or greater than 90% of the fair market value of the

equipment at the inception of the lease. Our leases in our

Latin America operations have historically been recorded

as operating leases given the cancellability of the contract

or because the recoverability of the lease investment is

deemed not to be predictable at lease inception.

The critical elements that we consider with respect to

our lease accounting are the determination of the

economic life and the fair value of equipment, including

the residual value. For purposes of determining the

economic life, we consider the most objective measure to

be the original contract term, since most equipment is

returned by lessees at or near the end of the contracted

term. The economic life of most of our products is five

years since this represents the most frequent contractual

lease term for our principal products and only a small

percentage of our leases have original terms longer than

five years. We continually evaluate the economic life of

both existing and newly introduced products for purposes

of this determination. Residual values, if any, are

established at lease inception using estimates of fair value

at the end of the lease term.

The vast majority of our leases that qualify as sales-

type are non-cancelable and include cancellation penalties

approximately equal to the full value of the lease

receivables. A portion of our business involves sales to

governmental units. Governmental units are those entities

that have statutorily defined funding or annual budgets

that are determined by their legislative bodies. Certain of

our governmental contracts may have cancellation

provisions or renewal clauses that are required by law,

such as 1) those dependant on fiscal funding outside of a

governmental unit’s control, 2) those that can be

cancelled if deemed in the best interest of the

governmental unit’s taxpayers or 3) those that must be

renewed each fiscal year, given limitations that may exist

on entering into multi-year contracts that are imposed by

statute. In these circumstances, we carefully evaluate

these contracts to assess whether cancellation is remote.

The evaluation of a lease agreement with a renewal

option includes an assessment as to whether the renewal

is reasonably assured based on the apparent intent and

our experience of such governmental unit. We further

ensure that the contract provisions described above are

offered only in instances where required by law. Where

86