Xerox 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

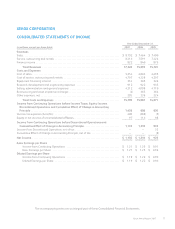

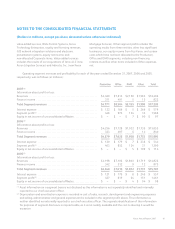

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

The following table summarizes certain significant charges that require management estimates:

Year Ended December 31,

(in millions) 2007 2006 2005

Restructuring provisions and asset impairments ..................................... $ (6) $385 $366

Amortization of intangible assets .................................................. 46 45 42

Provisions for receivables ......................................................... 131 76 51

Provisions for obsolete and excess inventory ........................................ 66 69 56

Provisions for litigation and regulatory matters ..................................... (6) 89 115

Depreciation and obsolescence of equipment on operating leases .................... 269 230 205

Depreciation of buildings and equipment ........................................... 262 277 280

Amortization of internal use and product software .................................. 79 84 114

Pension benefits – net periodic benefit cost ......................................... 235 355 343

Other post-retirement benefits – net periodic benefit cost ............................ 102 117 117

Deferred tax asset valuation allowance provisions ................................... 14 12 (38)

Changes in Estimates: In the ordinary course of

accounting for items discussed above, we make changes in

estimates as appropriate, and as we become aware of

circumstances surrounding those estimates. Such changes

and refinements in estimation methodologies are

reflected in reported results of operations in the period in

which the changes are made and, if material, their effects

are disclosed in the Notes to the Consolidated Financial

Statements.

New Accounting Standards and Accounting Changes:

Business Combinations and Noncontrolling

Interests: In December 2007, the FASB issued SFAS

No. 141 (revised 2007), “Business Combinations” (“FAS

141(R)”), and SFAS No. 160, “Noncontrolling Interests in

Consolidated Financial Statements – an amendment of

ARB No. 51” (“FAS 160”).

FAS 141(R) significantly changes the accounting for

business combinations. Under FAS 141(R), an acquiring

entity will be required to recognize all the assets acquired

and liabilities assumed in a transaction at the acquisition-

date at fair value with limited exceptions. FAS 141(R)

further changes the accounting treatment for certain

specific items, including:

• Acquisition costs will be generally expensed as

incurred;

• Noncontrolling interests (formerly known as “minority

interests” – see FAS 160 discussion below) will be

valued at fair value at the acquisition date;

• Acquired contingent liabilities will be recorded at fair

value at the acquisition date and subsequently

measured at either the higher of such amount or the

amount determined under existing guidance for

non-acquired contingencies;

• In-process research and development (IPRD) will be

recorded at fair value as an indefinite-lived intangible

asset at the acquisition date;

• Restructuring costs associated with a business

combination will be generally expensed subsequent to

the acquisition date; and

• Changes in deferred tax asset valuation allowances

and income tax uncertainties after the acquisition

date generally will affect income tax expense.

FAS 141(R) includes a substantial number of new

disclosure requirements. FAS 141(R) applies prospectively

to our business combinations for which the acquisition

date is on or after January 1, 2009.

FAS 160 establishes new accounting and reporting

standards for the noncontrolling interest in a subsidiary

and for the deconsolidation of a subsidiary. Specifically,

this statement requires the recognition of noncontrolling

interests (minority interests) as equity in the consolidated

financial statements and separate from the parent’s

equity. The amount of net income attributable to

noncontrolling interests will be included in consolidated

net income on the face of the income statement. FAS 160

82