Xerox 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

of synergies between the entities, which do not qualify as

an amortizable intangible asset. The allocations were

based on third-party valuations and management’s

estimates.

Amici LLC: In July 2006, we acquired all of the net

assets of Amici LLC (“Amici”), a provider of electronic-

discovery (e-discovery), services for $175 in cash, including

transaction costs. Amici provides comprehensive litigation

discovery management services, including the conversion,

hosting and production of electronic and hardcopy

documents. Amici also provides consulting and

professional services to assist attorneys in the discovery

process. The purchase agreement requires us to pay the

sellers an additional $20 if certain performance targets

are achieved in 2008, which would be an addition to the

acquired cost of the entity. The operating results of Amici

were not material to our financial statements and are

included within our Other segment from the date of

acquisition.

The purchase price was allocated to Net assets $2,

Intangible assets $37 (consisting of customer relationships

of $29 and software of $8), and Goodwill of $136. The

primary elements that generated the Goodwill are the

value of synergies and the acquired assembled workforce,

neither of which qualify as a separate intangible asset. The

allocations were based on third-party valuations and

management’s estimates.

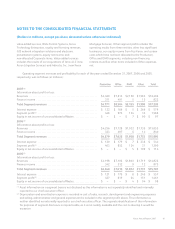

Note 4 – Receivables, Net

Finance Receivables: Finance receivables result from installment arrangements and sales-type leases arising from

the marketing of our equipment. These receivables are typically collateralized by a security interest in the underlying

assets. Finance receivables, net at December 31, 2007 and 2006 were as follows (in millions):

2007 2006

Gross receivables ........................................................................... $9,643 $ 9,389

Unearned income .......................................................................... (1,461) (1,437)

Unguaranteed residual values ............................................................... 69 90

Allowance for doubtful accounts ............................................................. (203) (198)

Finance receivables, net ..................................................................... 8,048 7,844

Less: Billed portion of finance receivables, net ................................................. (304) (273)

Current portion of finance receivables not billed, net ........................................... (2,693) (2,649)

Amounts due after one year, net ............................................................. $5,051 $ 4,922

Contractual maturities of our gross finance receivables as of December 31, 2007 were as follows (including those

already billed of $304 (in millions):

2008 2009 2010 2011 2012 Thereafter Total

$3,652 $2,665 $1,863 $1,054 $371 $38 $9,643

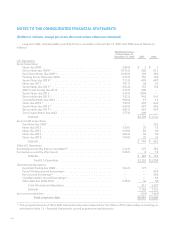

Secured Funding Arrangements

GE Secured Borrowings: We have an agreement in

the U.S. (the “Loan Agreement”) under which General

Electric Capital Corporation, a subsidiary of GE, provides

secured funding for our customer leasing activities in the

U.S. The maximum potential level of borrowing under

this agreement is a function of the size of the portfolio of

finance receivables generated by us that meet GE’s

funding requirements and cannot exceed $5 billion.

Under this agreement, new lease originations funded

by GE, were transferred to a wholly-owned consolidated

subsidiary. The funds received under this agreement are

recorded as secured borrowings and together with the

associated lease receivables are included in our

Consolidated Balance Sheet. We and GE intended for the

transfers of the lease contracts to be “true sales at law”

and that the wholly-owned consolidated subsidiary

94