Xerox 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

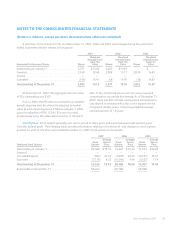

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

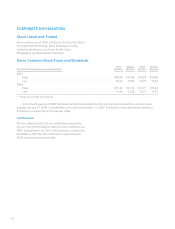

compensation plans, 48 million shares were reserved for

debt to equity exchanges, 15 million shares were reserved

for the conversion of the Series C Mandatory Convertible

Preferred Stock and 2 million shares were reserved for the

conversion of convertible debt. The 15 million shares

reserved for the conversion of the Series C Mandatory

Convertible Preferred Stock were released in January

2008.

Stock-Based Compensation: We have a long-term

incentive plan whereby eligible employees may be granted

restricted stock units (“RSUs”), performance shares (“PSs”)

and non-qualified stock options.

In 2005, we implemented changes in our stock-based

compensation programs designed to help us continue to

attract and retain employees and to better align

employee interests with those of our shareholders. With

these changes, in lieu of stock options we began granting

PSs and expanded the use of RSUs. Each of these awards

is subject to settlement with newly issued shares of our

common stock. At December 31, 2007 and 2006,

19 million and 25 million shares, respectively, were

available for grant of awards.

Total compensation related to these programs was

$89, $64 and $40 for the years ended December 31,

2007, 2006 and 2005, respectively. The related income

tax benefit recognized was $34, $25 and $16 for 2007,

2006 and 2005, respectively. A description of each of our

stock-based compensation programs follows:

Restricted Stock Units: Prior to 2005, the RSUs were

generally subject to a three-year ratable vesting period

from the date of grant and entitled the holder to one

share of common stock. In 2005, the terms of newly-

issued RSUs were changed such that the entire award

vests three years from the date of grant. Compensation

expense is based upon the grant date market price and is

recorded over the vesting period. A summary of the

activity for RSUs as of December 31, 2007, 2006 and

2005, and changes during the years then ended, is

presented below (shares in thousands):

2007 2006 2005

Nonvested Restricted Stock Units Shares

Weighted

Average Grant

Date Fair

Value Shares

Weighted

Average Grant

Date Fair

Value Shares

Weighted

Average Grant

Date Fair

Value

Outstanding at January 1 .................... 8,635 $15.71 5,491 $15.69 2,804 $13.86

Granted .................................... 4,444 18.17 4,256 15.18 3,750 16.89

Vested ...................................... (935) 13.65 (686) 13.70 (977) 15.01

Cancelled ................................... (448) 16.42 (426) 13.45 (86) 16.21

Outstanding at December 31 .............. 11,696 16.78 8,635 15.71 5,491 15.69

At December 31, 2007, the aggregate intrinsic value

of RSUs outstanding was $189. The total intrinsic value of

RSUs vested during 2007, 2006 and 2005 was $16, $10

and $13, respectively. The actual tax benefit realized for

the tax deductions for vested RSUs totaled $3, $3 and $4

for the years ended December 31, 2007, 2006 and 2005,

respectively.

At December 31, 2007, there was $89 of total

unrecognized compensation cost related to nonvested

RSUs, which is expected to be recognized ratably over a

remaining weighted-average contractual term of 1.9

years.

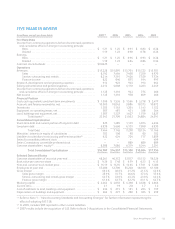

Performance Shares: We grant officers and selected

executives PSs whose vesting is contingent upon meeting

pre-determined Diluted Earnings per Share (“EPS”) and

Cash Flow from Operations targets. These shares entitle

the holder to one share of common stock, payable after a

three-year period and the attainment of the stated goals.

If the cumulative three-year actual results for EPS and

Cash Flow from Operations exceed the stated targets,

then the plan participants have the potential to earn

additional shares of common stock. This overachievement

can not exceed 50% for officers and 25% for non-officers

of the original grant.

128