Xerox 2007 Annual Report Download - page 128

Download and view the complete annual report

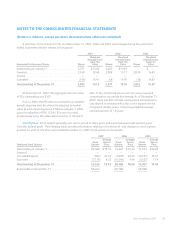

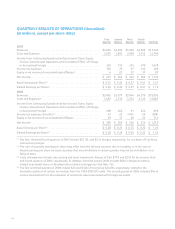

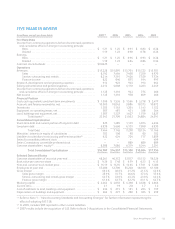

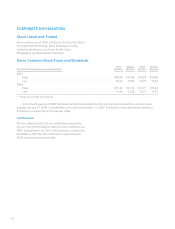

Please find page 128 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

have told the MCA that Xerox’s conduct in voluntarily

disclosing the initial information and readily and willingly

submitting to investigation, coupled with the

non-availability of earlier records, warrants complete

closure and early settlement. In January 2006, we learned

that the MCA has issued a “Show Cause Notice” to certain

former executives of Xerox India Ltd. seeking a response

to allegations of potential violations of the Indian

Companies Act. We also learned that Xerox India Ltd. has

received a formal Notice of Enquiry from the Indian

Monopolies & Restrictive Trade Practices Commission

(“MRTP Commission”) alleging that Xerox India Ltd.

committed unfair trading practices arising from the

events described in the DCA investigator’s Report.

Following a hearing on August 29, 2006, the MRTP

Commission ordered a process with deadlines between

Xerox India Ltd. and the investigating officer for provision

of relevant documents to Xerox India Ltd., after which

Xerox India Ltd. will have four weeks to file its reply. The

MRTP Commission scheduled a hearing for framing of the

issues on January 9, 2007, but this hearing was delayed. A

new hearing was scheduled for January 29, 2007 for

consideration of Xerox India Ltd.’s motion for the MRTP

Commission to direct the investigating officer to supply us

the relevant documents. At the hearing on January 29th,

no additional documents were supplied to us. The MRTP

Commission directed us to file our reply to the original

Notice of Enquiry within four weeks. At a hearing on

April 2, 2007, the investigating officer requested another

copy of our reply for the purpose of filing a response. An

additional period of four weeks to file this response was

granted, and the next hearing date was set for May 15,

2007 for further consideration and framing of issues. The

matter was heard on May 15, 2007, but the investigating

officer sought additional time to file his response, which in

fact was filed on June 27, 2007. The Commission

rescheduled the matter for August 17, 2007 for further

proceedings. At the hearing on August 17, 2007, counsel

for Xerox India Ltd. argued that the Enquiry is not

properly maintainable under the Commission’s

jurisdiction. The issue of maintainability of the Notice of

Enquiry has been framed as the preliminary issue and the

Commission will decide this at the next hearing date,

which has been rescheduled for March 2008. Our Indian

subsidiary plans to contest the Notice of Enquiry and has

been fully cooperating with the authorities.

Other contingencies

Guarantees, Indemnifications and Warranty

Liabilities: Guarantees and claims arise during the

ordinary course of business from relationships with

suppliers, customers and nonconsolidated affiliates when

the Company undertakes an obligation to guarantee the

performance of others if specified triggering events occur.

Nonperformance under a contract could trigger an

obligation of the Company. These potential claims include

actions based upon alleged exposures to products, real

estate, intellectual property such as patents,

environmental matters, and other indemnifications. The

ultimate effect on future financial results is not subject to

reasonable estimation because considerable uncertainty

exists as to the final outcome of these claims. However,

while the ultimate liabilities resulting from such claims

may be significant to results of operations in the period

recognized, management does not anticipate they will

have a material adverse effect on the Company’s

consolidated financial position or liquidity. As of

December 31, 2007, we have accrued our estimate of

liability incurred under our indemnification arrangements

and guarantees.

Indemnifications provided as part of contracts and

agreements: We are a party to the following types of

agreements pursuant to which we may be obligated to

indemnify the other party with respect to certain matters:

• Contracts that we entered into for the sale or purchase

of businesses or real estate assets, under which we

customarily agree to hold the other party harmless

against losses arising from a breach of representations

and covenants, including obligations to pay rent.

Typically, these relate to such matters as adequate

title to assets sold, intellectual property rights,

specified environmental matters and certain income

taxes arising prior to the date of acquisition.

• Guarantees on behalf of our subsidiaries with respect

to real estate leases. These lease guarantees may

remain in effect subsequent to the sale of the

subsidiary.

• Agreements to indemnify various service providers,

trustees and bank agents from any third party claims

related to their performance on our behalf, with the

exception of claims that result from third-party’s own

willful misconduct or gross negligence.

126