Xerox 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

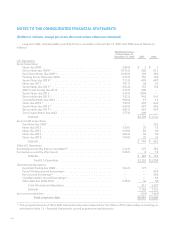

Note 10 – Supplementary Financial Information

The components of other current assets and other

current liabilities at December 31, 2007 and 2006 were as

follows (in millions):

2007 2006

Other current assets

Deferred taxes ....................... $ 200 $ 271

Restricted cash ....................... 45 236

Prepaid expenses ..................... 120 119

Financial derivative instruments ....... 27 9

Other ............................... 290 299

Total Other current assets ....... $ 682 $ 934

Other current liabilities

Income taxes payable ................ $ 84 $ 63

Other taxes payable .................. 179 157

Interest payable ..................... 137 128

Restructuring reserves ................ 81 291

Unearned income .................... 242 194

Financial derivative instruments ....... 30 17

Product warranties ................... 25 21

Dividends payable .................... 40 –

Other ............................... 694 546

Total Other current

liabilities ..................... $1,512 $1,417

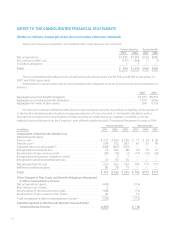

The components of other long-term assets and other

long-term liabilities at December 31, 2007 and 2006 were

as follows (in millions):

2007 2006

Other long-term assets

Prepaid pension costs ................. $ 322 $ 19

Net investment in discontinued

operations(1) ....................... 277 295

Internal use software, net ............. 270 217

Restricted cash ....................... 219 190

Debt issuance costs, net ............... 47 48

Other ................................ 293 282

Total Other long-term assets ..... $1,428 $1,051

Other long-term liabilities

Deferred and other tax liabilities ....... $ 250 $ 223

Minorities’ interests in equity of

subsidiaries ........................ 103 108

Financial derivative instruments ....... 14 42

Other ................................ 429 448

Total Other long-term liabilities .. $ 796 $ 821

(1) At December 31, 2007, our net investment in

discontinued operations primarily consists of a $305

performance-based instrument relating to the 1997

sale of The Resolution Group (“TRG”) net of remaining

net liabilities associated with our discontinued

operations of $28. The recovery of the performance-

based instrument is dependent on the sufficiency of

TRG’s available cash flows, as guaranteed by TRG’s

ultimate parent, which are expected to be recovered in

annual cash distributions through 2017.

Note 11 – Debt

Short-term borrowings at December 31, 2007 and

2006 were as follows (in millions):

2007 2006

Currentmaturitiesoflong-termdebt .... $426 $1,465

Notes payable ...................... 18 20

France Bridge Facility due 2008 ...... 81 –

Total ................................ $525 $1,485

We classify our debt based on the contractual

maturity dates of the underlying debt instruments or as of

the earliest put date available to the debt holders. We

defer costs associated with debt issuance over the

applicable term or to the first put date, in the case of

convertible debt or debt with a put feature. These costs are

amortized as interest expense in our Consolidated

Statements of Income.

Xerox Annual Report 2007 103