Xerox 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

We employ a total return investment approach

whereby a mix of equities and fixed income investments

are used to maximize the long-term return of plan assets

for a prudent level of risk. The intent of this strategy is to

minimize plan expenses by exceeding the interest growth

in long-term plan liabilities. Risk tolerance is established

through careful consideration of plan liabilities, plan

funded status, and corporate financial condition. This

consideration involves the use of long-term measures that

address both return and risk. The investment portfolio

contains a diversified blend of equity and fixed income

investments. Furthermore, equity investments are

diversified across U.S. and non-U.S. stocks as well as

growth, value and small and large capitalizations. Other

assets such as real estate, private equity, and hedge funds

are used to improve portfolio diversification. Derivatives

may be used to hedge market exposure in an efficient and

timely manner; however, derivatives may not be used to

leverage the portfolio beyond the market value of the

underlying investments. Investment risks and returns are

measured and monitored on an ongoing basis through

annual liability measurements and quarterly investment

portfolio reviews.

Expected Long Term Rate of Return: We employ a

“building block” approach in determining the long-term

rate of return for plan assets. Historical markets are

studied and long-term relationships between equities and

fixed income are assessed. Current market factors such as

inflation and interest rates are evaluated before long-term

capital market assumptions are determined. The long-term

portfolio return is established giving consideration to

investment diversification and rebalancing. Peer data and

historical returns are reviewed periodically to assess

reasonableness and appropriateness.

Contributions: We expect to contribute

approximately $130 to our worldwide defined benefit

pension plans and approximately $100 to our other post

retirement benefit plans in 2008. The 2008 expected

pension plan contributions do not include any planned

contribution for our domestic tax-qualified defined benefit

plans because there are no required contributions to these

plans for the 2008 fiscal year. However, once the

January 1, 2008 actuarial valuations and projected results

as of the end of the 2008 measurement year are available,

the desirability of additional contributions will be

reassessed. Based on these results, we may voluntarily

decide to contribute to these plans, even though no

contribution is required. In 2007 and 2006, after making

this assessment, we contributed $158 and $228,

respectively, to our domestic tax qualified plans to make

them 100% funded on a current liability basis under the

ERISA funding rules.

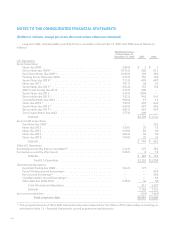

Estimated Future Benefit Payments: The following

benefit payments, which reflect expected future service, as

appropriate, are expected to be paid during the following

years (in millions):

Pension

Benefits Retiree

Health

2008 ............................... $ 732 $105

2009 ............................... 645 114

2010 ............................... 675 119

2011 ............................... 690 123

2012 ............................... 758 127

Years 2013–2017 .................... 3,977 635

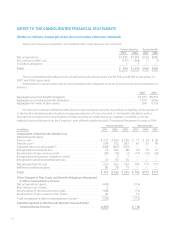

Assumptions Pension Benefits Retiree Health

2007 2006 2005 2007 2006 2005

Weighted-average assumptions used to determine benefit obligations at

the plan measurement dates

Discount rate ............................................................ 5.9% 5.3% 5.2% 6.2% 5.8% 5.6%

Rate of compensation increase ............................................ 4.1 4.1 3.9 – (1) –(1) –(1)

(1) Rate of compensation increase is not applicable to the retiree health benefits as compensation levels do not impact

earned benefits.

114