Xerox 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 gross margins of 40.3% were slightly below

prior year as cost improvements were offset by product

mix and pricing. Selling, administrative and general

(“SAG”) expense as a percent of revenue was 0.2-

percentage points lower year over year. SAG expenses

grew as the inclusion of GIS and unfavorable currency

offset the benefits of prior restructuring. Additionally, we

continued to invest in research and development and to

prioritize our investments to the faster growing areas of

the market.

Our balance sheet strategy focused on optimizing

operating cash flows and returning value to shareholders

through acquisitions, share repurchase and dividends. We

continue to maintain debt levels primarily to support our

customer financing operations as debt associated with our

acquisition of GIS was effectively repaid by year-end. We

also continued our strategy to replace debt secured by our

finance receivables with new unsecured debt, reducing the

percentage of secured debt to total debt to a modest 4%.

The successful implementation of this strategy enabled us

to significantly strengthen our balance sheet and led to

our third investment grade credit rating, thereby

completing the transition to a high-grade credit.

We finished the year with a cash and cash

equivalents balance of $1.1 billion. Our prospective

balance sheet strategy includes: optimizing operating cash

flows, maintaining our investment grade credit ratings,

achieving an optimal cost of capital and effectively

deploying cash to deliver and maximize long-term

shareholder value. Our strategy also includes maintaining

an appropriate leverage of our financing assets (finance

receivables and equipment on operating leases) and an

appropriate level of non-financing debt.

During 2007 we declared our first quarterly dividend

in six years. A dividend of 4.25 cents per share was paid on

January 31, 2008 to shareholders of record on

December 31, 2007. The dividend declaration underscores

our confidence in our business model and the health of

our business, which is the foundation for our strong

financial position.

Currency Impacts

To understand the trends in the business, we believe

that it is helpful to analyze the impact of changes in the

translation of foreign currencies into U.S. dollars on

revenues and expenses. We refer to this analysis as

“currency impact” or “the impact from currency”. Revenues

and expenses from our Developing Markets Operations

(“DMO”) are analyzed at actual exchange rates for all

periods presented, since these countries generally have

volatile currency and inflationary environments, and our

operations in these countries have historically

implemented pricing actions to recover the impact of

inflation and devaluation. We do not hedge the

translation effect of revenues or expenses denominated in

currencies where the local currency is the functional

currency.

Approximately 50% of our consolidated revenues are

derived from operations outside of the United States

where the U.S. dollar is not the functional currency. When

compared with the average of the major European

currencies on a revenue-weighted basis, the U.S. dollar was

9% weaker in 2007 and unchanged in 2006 and 2005. As

a result, the foreign currency translation impact on

revenue was a 3% benefit in 2007 and negligible in 2006.

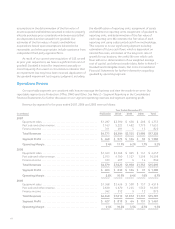

Summary Results

Revenues

Revenues for the three years ended December 31, 2007 were as follows:

(in millions)

Year Ended December 31, Percent Change

2007 2006 2005 2007 2006

Equipment sales ................................................... $ 4,753 $ 4,457 $ 4,519 7% (1)%

Post sale and other revenue(1) ...................................... 11,653 10,598 10,307 10% 3%

Finance income ................................................... 822 840 875 (2)% (4)%

Total Revenue .................................................... $17,228 $15,895 $15,701 8% 1%

Xerox Annual Report 2007 53