Xerox 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

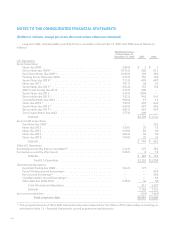

The following summarizes the original principal amounts of those instruments as of December 31, 2007:

Senior Notes due 2009 ....................................................................... $ 600

Euro Senior Notes due 2009 .................................................................. 331

Senior Notes due 2010 ....................................................................... 700

Senior Notes due 2011 ....................................................................... 750

Senior Notes due 2012 ....................................................................... 1,100

Senior Notes due 2013 ....................................................................... 550

Notes due 2016 ............................................................................. 250

Senior Notes due 2016 ....................................................................... 700

Senior Notes due 2017 ....................................................................... 500

(2) Refer to Note 4 – Receivables, Net for further discussion of borrowings secured by finance receivables, net.

Scheduled payments due on long-term debt for the next five years and thereafter are as follows (in millions):

2008 2009 2010 2011 2012 Thereafter Total

$426(1) $1,552 $707 $808 $1,721 $2,151 $7,365

(1) Quarterly total debt maturities for 2008 are $106, $60, $223 and $37 for the first, second, third and fourth quarters,

respectively.

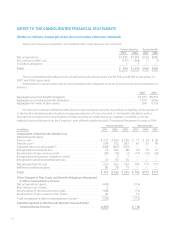

2007 Credit Facility

In 2007, we amended and restated our $1.25 billion

unsecured 2006 credit facility. The amended and restated

facility (the “2007 Credit Facility”) increased the

maximum amount available for borrowing to $2 billion

and includes a $300 letter of credit subfacility. The Facility

is available, without sublimit, to certain of our qualifying

subsidiaries and includes provisions that would allow us to

increase the overall size of the Facility up to an aggregate

amount of $2.5 billion. It matures in 2012, although we

have the right to request a one year extension on each of

the first and second anniversaries of the Facility. Our

obligations under the Facility are unsecured and are not

currently guaranteed by any of our subsidiaries. In the

event that any of our subsidiaries borrows under the

Facility, its borrowings thereunder would be guaranteed by

us.

Borrowings under the 2007 Credit Facility bear

interest at LIBOR plus a spread that will vary between

0.18% and 0.75% depending on our then current credit

ratings. The spread as of December 31, 2007 was 0.35%.

In addition, we are required to pay a facility fee on the

aggregate amount of the revolving credit facility. As of

December 31, 2007, we had borrowings of $600 and no

outstanding letters of credit under the 2007 Credit Facility

and the facility fee rate was 0.10%.

The facility contains various conditions to borrowing,

and affirmative, negative and financial maintenance

covenants. Certain of the more significant covenants are

summarized below:

(a) Maximum leverage ratio (a quarterly test that is

calculated as debt for borrowed money divided

by consolidated EBITDA) ranging from 4.00 to

3.25 over the life of the facility.

(b) Minimum interest coverage ratio (a quarterly

test that is calculated as consolidated EBITDA

divided by consolidated interest expense) may

not be less than 3.00:1.

(c) Limitations on (i) liens securing debt of Xerox and

certain of our subsidiaries, (ii) certain

fundamental changes to corporate structure,

(iii) changes in nature of business and

(iv) limitations on debt incurred by certain

subsidiaries.

The 2007 Credit Facility also contains various events

of default, the occurrence of which could result in a

termination by the lenders and the acceleration of all our

obligations under the Facility. These events of default

include, without limitation:

(i) payment defaults, (ii) breaches of covenants under

the Facility (certain of which breaches do not have

Xerox Annual Report 2007 105