Xerox 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assumptions in the determination of the fair value of

assets acquired and liabilities assumed in order to properly

allocate purchase price consideration between assets that

are depreciated and amortized from goodwill. Our

estimates of the fair values of assets and liabilities

acquired are based upon assumptions believed to be

reasonable, and when appropriate, include assistance from

independent third-party appraisal firms.

As result of our current year acquisition of GIS, as well

as prior year acquisitions, we have a significant amount of

goodwill. Goodwill is tested for impairment annually or

more frequently if an event or circumstance indicates that

an impairment loss may have been incurred. Application of

the goodwill impairment test requires judgment, including

the identification of reporting units, assignment of assets

and liabilities to reporting units, assignment of goodwill to

reporting units, and determination of the fair value of

each reporting unit. We estimate the fair value of each

reporting unit using a discounted cash flow methodology.

This requires us to use significant judgment including

estimation of future cash flows, which is dependent on

internal forecasts, estimation of the long-term rate of

growth for our business, the useful life over which cash

flows will occur, determination of our weighted average

cost of capital, and relevant market data. Refer to Note 8 –

Goodwill and Intangible Assets, Net in the Consolidated

Financial Statements for further information regarding

goodwill by operating segment.

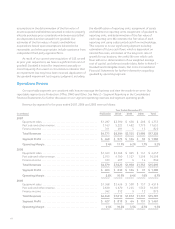

Operations Review

Our reportable segments are consistent with how we manage the business and view the markets we serve. Our

reportable segments are Production, Office, DMO and Other. See Note 2 – Segment Reporting in the Consolidated

Financial Statements for further discussion on our segment operating revenues and segment operating profit.

Revenue by segment for the years ended 2007, 2006 and 2005 were as follows:

Year Ended December 31,

(in millions) Production Office DMO Other Total

2007

Equipment sales ........................................... $1,297 $2,590 $ 658 $ 208 $ 4,753

Post sale and other revenue ................................. 3,163 5,223 1,492 1,775 11,653

Finance income ............................................ 311 491 5 15 822

Total Revenues ........................................... $4,771 $8,304 $2,155 $1,998 $17,228

Segment Profit ............................................ $ 448 $ 973 $ 134 $ 33 $ 1,588

Operating Margin ......................................... 9.4% 11.7% 6.2% 1.7% 9.2%

2006

Equipment sales ........................................... $1,343 $2,368 $ 605 $ 141 $ 4,457

Post sale and other revenue ................................. 2,913 4,760 1,327 1,598 10,598

Finance income ............................................ 323 497 6 14 840

Total Revenues ........................................... $4,579 $7,625 $1,938 $1,753 $15,895

Segment Profit ............................................ $ 403 $ 832 $ 124 $ 31 $ 1,390

Operating Margin ......................................... 8.8% 10.9% 6.4% 1.8% 8.7%

2005

Equipment sales ........................................... $1,368 $2,436 $ 558 $ 157 $ 4,519

Post sale and other revenue ................................. 2,830 4,670 1,245 1,562 10,307

Finance income ............................................ 342 512 9 12 875

Total Revenues ........................................... $4,540 $7,618 $1,812 $1,731 $15,701

Segment Profit ............................................ $ 427 $ 819 $ 64 $ 151 $ 1,461

Operating Margin ......................................... 9.4% 10.8% 3.5% 8.7% 9.3%

60