Xerox 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

We enter into limited types of derivative contracts,

including interest rate and cross currency interest rate

swap agreements, foreign currency spot, forward and

swap contracts and net purchased foreign currency

options to manage interest rate and foreign currency

exposures. Our primary foreign currency market

exposures include the Japanese Yen, Euro, and British

pound sterling. The fair market values of all our

derivative contracts change with fluctuations in interest

rates and/or currency rates and are designed so that any

changes in their values are offset by changes in the

values of the underlying exposures. Derivative financial

instruments are held solely as risk management tools and

not for trading or speculative purposes.

By their nature, all derivative instruments involve, to

varying degrees, elements of market and credit risk not

recognized in our financial statements. The market risk

associated with these instruments resulting from

currency exchange and interest rate movements is

expected to offset the market risk of the underlying

transactions, assets and liabilities being hedged. We do

not believe there is significant risk of loss in the event of

non-performance by the counterparties associated with

these instruments because these transactions are

executed with a diversified group of major financial

institutions. Further, our policy is to deal with

counterparties having a minimum investment-grade or

better credit rating. Credit risk is managed through the

continuous monitoring of exposures to such

counterparties.

Interest Rate Risk Management: We use interest

rate swap agreements to manage our interest rate

exposure and to achieve a desired proportion of variable

and fixed rate debt. These derivatives may be designated

as fair value hedges or cash flow hedges depending on

the nature of the risk being hedged. At December 31,

2007 and 2006, we had outstanding single currency

interest rate swap agreements with aggregate notional

amounts of $1.1 billion and $1.7 billion, respectively. The

net liability fair values at December 31, 2007 and 2006

were $6 and $41, respectively.

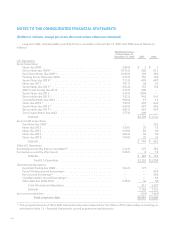

Fair Value Hedges: As of December 31, 2007 and 2006, pay variable/receive fixed interest rate swaps with notional

amounts of $1.1 billion and $1.4 billion were designated and accounted for as fair value hedges. The swaps were

structured to hedge the fair value of related debt by converting them from fixed rate instruments to variable rate

instruments. No ineffective portion was recorded to earnings during 2007, 2006, or 2005. The following is a summary of

our fair value hedges at December 31, 2007:

Debt Instrument Year First

Designated Notional

Amount

Net

Fair

Value

Weighted

Average

Interest

Rate Paid Interest

Rate Received Basis Maturity

Senior Notes due 2010 ................... 2003/2005 $ 250 $ (3) 8.02% 7.13% Libor 2010

Notes due 2016 ......................... 2004 250 (4) 7.28% 7.20% Libor 2016

Senior Notes due 2011 ................... 2004 125 (1) 7.63% 6.88% Libor 2011

Liability to Capital Trust I ................. 2005 450 14 7.79% 8.00% Libor 2027

Total ............................... $1,075 $ 6

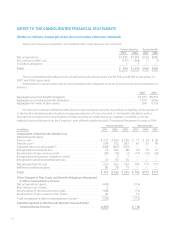

Cash Flow Hedges: During 2006, pay fixed/receive

variable interest rate swaps with notional amounts of

£200 million ($392) and a net asset fair value of $1,

associated with the U.K. GE secured borrowing were

designated and accounted for as cash flow hedges. The

swaps were structured to hedge the LIBOR interest rate of

the debt by converting it from a variable rate instrument

to a fixed rate instrument. The swaps were terminated in

connection with the repayment of this borrowing in July

2007. No ineffective portion was recorded to earnings

during 2007 and 2006. Refer to Note 4 – Receivables, Net

for additional information.

Terminated Swaps: During the period from 2004 to

2007, we terminated interest rate swaps which had been

designated as fair value hedges of certain debt

instruments. These terminated interest rate swaps had an

aggregate notional value of $2.6 billion. The associated

net fair value adjustments to the debt instruments are

being amortized to interest expense over the remaining

108