Xerox 2007 Annual Report Download - page 85

Download and view the complete annual report

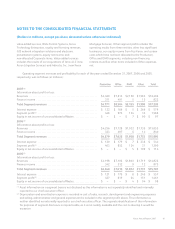

Please find page 85 of the 2007 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

clarifies that changes in a parent’s ownership interest in a

subsidiary that does not result in deconsolidation are

treated as equity transactions if the parent retains its

controlling financial interest. In addition, this statement

requires that a parent recognize a gain or loss in net

income when a subsidiary is deconsolidated. Such gain or

loss will be measured using the fair value of the

noncontrolling equity investment on the deconsolidation

date. FAS 160 also includes expanded disclosure

requirements regarding the interests of the parent and its

noncontrolling interest.

FAS 160 is effective for our fiscal year, and interim

periods within such year, beginning January 1, 2009. Early

adoption of both FAS 141(R) and FAS 160 is prohibited.

The adoption of FAS 160 will result in the reclassification

of minority interests from long term liabilities to

shareholders’ equity. The balance at December 31, 2007

was $103. We are currently evaluating further impacts, if

any, of these standards on our financial statements.

Income Tax Accounting: In 2006, the FASB issued

Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes – an Interpretation of FASB Statement

No. 109” (“FIN 48”) which we adopted on January 1,

2007. FIN 48 clarifies the accounting for uncertainty in

income taxes by prescribing a minimum recognition

threshold for a tax position taken or expected to be taken

in a tax return that is required to be met before being

recognized in the financial statements. FIN 48 also

provides guidance on derecognition, measurement,

classification, interest and penalties, accounting in interim

periods, disclosure and transition. The cumulative effect of

adopting FIN 48 of $2 was recorded as a reduction to

Retained earnings. The total amount of unrecognized tax

benefits as of the date of adoption was $287. Refer to

Note 15-Income and Other Taxes for additional

information regarding unrecognized tax benefits.

Benefit Plans Accounting: In 2006, the FASB issued

SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans, an amendment

of FASB Statements No. 87, 88, 106 and 132(R)” (“FAS

158”) which requires the recognition of an asset or liability

for the funded status of defined pension and other

postretirement benefit plans in the statement of financial

position of the sponsoring entity. The funded status of a

benefit plan is measured as the difference between plan

assets at fair value and the benefit obligation. The initial

incremental recognition of the funded status under FAS

158 of our defined pension and other post retirement

benefit plans, as well as subsequent changes in our funded

status that are not included in net periodic benefit cost will

be reflected in shareholders’ equity and other

comprehensive loss, respectively. As of December 31,

2006, the net unfunded status of our benefit plans was

$2,842 and recognition of this status upon the adoption

of FAS 158 resulted in an after-tax charge to equity of

$1,024. Prior to the adoption of FAS 158, we recorded an

after-tax credit to our minimum pension liability of $131,

for a total equity charge in 2006 related to the funded

status of our benefit plans of $893. Amounts recognized in

accumulated other comprehensive loss are adjusted as

they are subsequently recognized as a component of net

periodic benefit cost. The method of calculating net

periodic benefit cost will not change from existing

guidance. Refer to Note 14-Employee Benefit Plans for

additional information.

The funded status recognition and certain disclosure

provisions of FAS 158 were effective as of our fiscal year

ending December 31, 2006. FAS 158 also requires the

consistent measurement of plan assets and benefit

obligations as of the date of our fiscal year-end statement

of financial position effective for the year ending

December 31, 2008, with early adoption permitted. Since

several of our international plans currently have a

September 30th measurement date, this standard will

require us to change, in 2008, that measurement date to

December 31st. The adoption of this requirement by our

international plans will not have a material effect on our

financial condition or results of operations. The effect of

adoption by our international plans resulted in a

January 1, 2008 opening retained earnings charge of $16,

deferred tax asset increase of $4, pension asset reduction

of $9, a pension liability increase of $6 and a credit to

accumulated other comprehensive loss of $5.

FAS 158 was not effective for our equity investment

in Fuji Xerox (“FX”) until their annual year-end of

March 31, 2007. Upon FX’s adoption of FAS 158, we

recorded a $5 charge to equity representing our share of

their after-tax charge to equity for the unfunded status of

their benefit plans. We also recorded a $44 after-tax

charge to equity for our portion of a minimum pension

liability adjustment recorded by FX prior to their adoption

of FAS 158 for a total equity charge in 2007 related to the

funded status of FX’s benefit plans of $49.

Xerox Annual Report 2007 83